Managing outbound LA freight traffic has always been an issue during peak, but since June 2020 the challenges of limited capacity and escalating pricing has been a constant problem for all freight modes.

Managing outbound LA freight traffic has always been an issue during peak, but since June 2020 the challenges of limited capacity and escalating pricing has been a constant problem for all freight modes.

Having been in this industry now for over thirty years, I have seen many ups and downs in the outbound Los Angeles freight market, but nothing like what we have seen since June of last year.

Today’s challenges are not new to the SoCal outbound freight, but they have been amplified by the worldwide COVID19 pandemic to make “peak shipping” all year round versus just during the months of July through November.

Top 5 Reasons SoCal’s LA Area Has Freight Capacity Challenges

To help explain why Southern California is a challenge, we’ve pulled together a list of the top five stats to help explain the sheer volume of freight running through the Los Angeles market:

Southern California has averaged 7% of all outbound US for-hire truckload volumes and 20% of all US intermodal volume over the past two years.

Southern California has averaged 7% of all outbound US for-hire truckload volumes and 20% of all US intermodal volume over the past two years.

- In other words, SoCal is 1.5% of the total square miles of the US, yet comparing that to the outbound freight statistics shows the LA area is punching way above its weight class.

- To put that in perspective, Southern California is 56,505 square miles, while the total US is comprised of 3.8 million square feet.

- The Inland Empire, which is the metropolitan area centered around the Southern California cities of Riverside and San Bernardino, experienced tremendous warehousing growth with its vacancy rates dropping to a four-year low of 1.5%, according to CBRE Orange County and Inland Empire report.

- The total distribution and warehousing space is disproportionate to the square mileage comparison with SoCal representing roughly 5.8% of 10.2 billion warehouse and distribution space in the United States.

- The vacancy rate will increase slightly between now and Q2 2022, but that is only because of an additional 21 million square feet of new warehousing and distribution space being added to the already 581 million square feet already in the market.

- Roughly 25% of the total US TEU traffic comes from the combination of the Port of Los Angeles and the Port of Long Beach.

- Those numbers continue to increase because of continued expansion of US manufacturing based in the Pacific Rim countries.

- California’s seasonal produce season affects every freight market in the US, but no one more than the LA and Long Beach ports and Inland Empire.

- LA is land and sea locked.

- The congestion is obvious in just one trip out to the area. The number of people to support the logistics business in the area further congests the infrastructure and resources, making transport extremely difficult.

All said, the statistics of the Los Angeles outbound freight market is like trying to put ten pounds of “stuff” in a five-pound bag.

Consumer Patterns Changed as a Result of COVID19

To continue the conversation about how LA’s outbound freight market became more challenged as a result of COVID19, we first have to take a look at the consumer.

Consumers moved from in-store purchases to online.

Consumers moved from in-store purchases to online.

- Amazon delivers roughly 67% of their orders on their own trucks or with the small business partnerships they formed across the US.

- There are only so many people that want to drive trucks, and this transition has taken drivers out of the market.

- This move changed the demand for freight and logistics capacity because instead of consumers doing the final mile delivery, it is the small package carriers of UPS, FedEx, and Amazon making the deliveries to the home.

- COVID19 shifted consumers from buying services and experiences to buying products.

- To sum it up, service is not something that is shipped, so the dollars went to hard assets that are moved via truck or other freight modes.

- Without the option of travel and dining, consumers pushed their spending towards improving their homes and entertaining at home.

- Federal, state, and local governments pushed money into consumer accounts to keep them solvent while not being permitted to work. At the same time, demand increased for those businesses that could operate under COVID19 lockdown guidelines.

- As it turned out, this strategy helped bolster buying and still improved the average savings bank balance.

SoCal Outbound Freight Market Capacity Challenges Amplified

SoCal Outbound Freight Market Capacity Challenges Amplified

The long and short of the amplification of the challenges of the Los Angeles outbound freight can be traced back to consumer buying patterns and the freight market going from zero to 100 in 90 days.

- The slowdown of the economy put freight equipment out of position from “normal” freight flows.

- The result is that shipping equipment is massively imbalanced for all freight modes, particularly ocean and rail, making them less effective in moving their freight orders.

- The economic slowdown did not last as long or go as deep as anticipated because the government stepped in to keep consumers flush with cash through various economic relief packages.

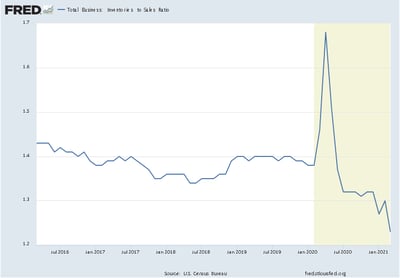

- The result is companies had significant out-of-stock challenges and to correct the situation they had to make massive buys to build inventory levels to normalize their inventory-to-sales ratio.

- The result is companies had significant out-of-stock challenges and to correct the situation they had to make massive buys to build inventory levels to normalize their inventory-to-sales ratio.

- Buying goods versus services has driven SoCal imports to historic highs for many consecutive months.

- While imports surged to record highs, the exports did not match, further exasperating the freight equipment imbalance.

- The import surge has congested the ports and increased dwell times.

- Ships at sea waiting to berth rose over the period of October thru May where it has essentially plateaued at a historic high.

- The ILWU, International Longshore and Warehouse Union, continue their push back on proven technology that would put US ports on the level with the best in the world. But for now, the union’s position is to protect jobs at all costs.

Conclusion on LA’s Capacity Constrained Freight Market

The result of all the above issues is that the outbound Los Angeles freight market is overloaded and not making meaningful improvements. For those of us that have run any type of operation understand, the long-term required fixes don’t happen quickly when the operation is at full throttle. The issue worsens when multiple parties are involved, which for a market the size of Southern California is thousands of moving entities trying to hold onto what they have before them.

The result of all the above issues is that the outbound Los Angeles freight market is overloaded and not making meaningful improvements. For those of us that have run any type of operation understand, the long-term required fixes don’t happen quickly when the operation is at full throttle. The issue worsens when multiple parties are involved, which for a market the size of Southern California is thousands of moving entities trying to hold onto what they have before them.

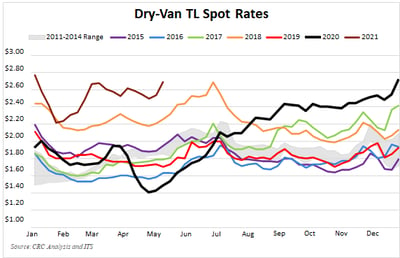

That said, shippers should expect the LA freight market to be constrained through this year and linger into at least the 1st quarter of 2022.

The capacity constrained market will keep spot freight pricing elevated until the end of the year, although to a lesser degree each subsequent month after the summer months are put in the rearview mirror.

For more on how to improve your company’s logistics position, we direct you to the following page that is dedicated specifically to the current freight market condition and what others have done to improve their position with freight capacity at a more reasonable price.

If you are looking for up-to-date data on the current market conditions that are published by some of the best in the business, we invite you to follow InTek’s LinkedIn page where we repost and comment on various stats and conditions in the freight market. Many have found the data helpful to explain to their C-level and give direction to building budgets.

MORE on InTek Freight & Logistics

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Below is a small sample of our more in-depth papers on key topics shippers have found useful in managing through their freight and logistics challenges that you too may find helpful:

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (54)

- Freight Broker (59)

- Freight Forwarder (2)

- Intermodal Transportation (183)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (418)

- Logistics Service Provider (76)

- LTL (39)

- Managed TMS (49)

- News (39)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (122)

- Warehousing & Distribution (50)