INTERMODAL NEWS & UPDATES IMPACTING YOUR BUSINESS TODAY - Sep 10, 2021

September 10, 2021 •Rick LaGore

September 10, 2021

The purpose of this weekly update is to provide shippers with the latest intermodal shipping news that is impacting freight capacity and service across both the US truckload and intermodal markets.

INTERMODAL RAMP UPDATES

Union Pacific

Macro Update:

Macro Update:

Overall chassis supply continues to be constrained coming off a long holiday weekend. This will be a common theme in all major markets as you read through the equipment update.

Union Pacific is very focused on restoring the health of their network to help generate capacity for customers. While they were making solid progress a couple weeks ago in restoring our network velocity, these efforts were unfortunately set back by the impacts from Hurricane Ida.

To help accelerate the pace of network velocity improvement, UP began taking more aggressive steps across their network to help restore service levels this week.

From an intermodal perspective, this means temporarily reduced gate reservations in specific, targeted lanes to help balance the network. The anticipation is for the following lanes to be metered for the next couple weeks.

ITR Temporarily Adjusted Lanes:

- G2 to Brooklyn

- G2 to Lathrop

- G2 to Salt Lake City

- G2 to Tacsim

- G2 to Sparks

- SLC to Marion

- Seattle to Marion

- Kansas City to Lathrop

- Kansas City to Portland

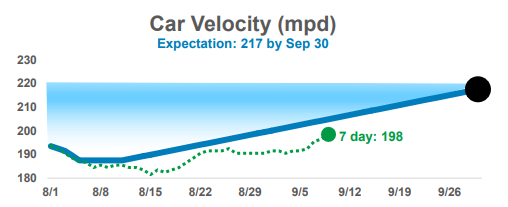

One of the key measures of the health the UP is constantly reviewing car velocity (car miles per day). Their goal is to get network velocity up to 217 mpd by the end of September. As of today, they are at 198.

Ramp Updates:

- LA: Supply was better this week than originally anticipated. Next week, the UP expects supply to be a little tighter than this week. Chassis constraints will continue to impact the number of available empties that are available for us to grant.

- Dallas: Capacity will continue to be very limited. Chassis supply remains in short supply and empty boxes have been loaded on cars and shuttled to deficit markets. Dallas will continue to be very limited as they try to use the surplus to supply southern markets. Chassis constraints will impact the availability.

- STIR: Capacity will continue to be very limited. They originally thought they would be in good shape this week, as extra empties were sent to STIR last weekend. Due to chassis constraints STOR has remained limited due to the number of available empties they have been able to grant and the ramp ended up having to stack extra empties as they arrived. They are pushing to get empties unstacked, but more than likely it will not happen until next week when we see relief on chassis limitations. Chassis constraints will impact availability.

- Laredo: Very limited supply. It is unlikely MCP demand will be filled out of this metro next week.

- Mexico: Next week, they are expecting to see a better supply to fill demand as more boxes coming in from Dallas over the next few days to move south into Mexico. The Mexico team is seeing more bad orders arrive, which they are working with vendors to identify and get them repaired quickly to keep them in the available pool. Due to demand MCP granting will continue to be very low but a little better than this week.

- Marion: Improved supply expected to continue to support MCP granting next week.

NS Updates

Operations still recovering from the impact of Hurricane Ida and chassis issues continue to plague capacity and operations at the various NS ramps.

CSX Updates

Nothing new to report. CSX operations continue to work through the backlog caused by Hurricane Ida.

CSX Transportation continues its restrictions to the number of domestic containers it will accept into Chicago, as the eastern US railroad struggles with heightened demand amid a disruption to Norfolk Southern Railway’s (NS’s) intermodal network.

BNSF Updates

BNSF operations continue to work through Hurricane Ida backlog.

BNSF operations continue to work through Hurricane Ida backlog.

KCS Updates

Customers should expect some delays until the backlog has been alleviated and normal speeds can be resumed over the Hurricane Ida affected areas.

Hurricane IDA Update

All intermodal operations are still recovering from the impact of Hurricane IDA.

Interchange operations are not allowed during the city-mandated curfew from 8:00 p.m. to 6:00 a.m.

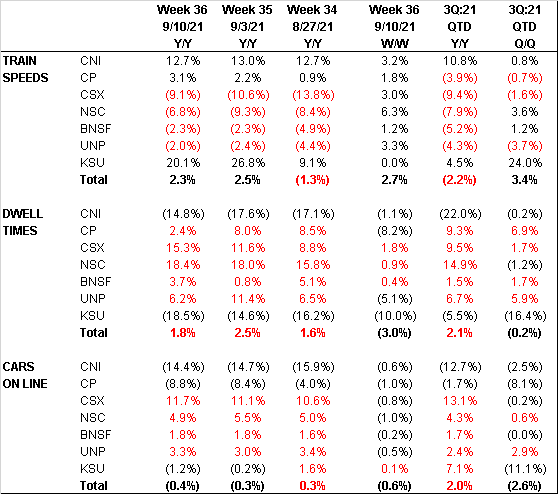

Class I Railroad Performance Indicators

Port & Drayage News

CMA-GMA Announces Immediate Suspension of Spot Rate Increases

The biggest news coming out of the ports is CMA-GMA's announcement that they are immediately suspending all spot rate increases until February 1, 2022. The move affects all services under the group brands: CMA CGM, CNC, Containerships, Mercosul, ANL, and APL.

CMA-GMA's announcement comes as US Federal Agencies push for transparency, pricing fairness and practices and service guarantees.

We would expect to see other maritime companies follow CMA-GMA's lead to help curtail shipper and government pushback on the rapid rise in rates and deterioration of service.

It is too soon to tell if this move will reverberate through all US freight modes.

Union Pacific Announces New and Updated Peak Surcharges

UP will raise surcharges for the fifth time this year in Los Angeles and implement surcharges in Dallas and Houston effective September 19, 2021.

Los Angeles outbound surcharge increased to $5,000 for each container in excess of the shipper's MCP agreement.

Dallas and Houston shipments will incur a $500 surcharge.

No changes were made to the Northern California, Portland or Seattle surcharges.

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (53)

- Freight Broker (58)

- Freight Forwarder (2)

- Intermodal Transportation (181)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (414)

- Logistics Service Provider (76)

- LTL (39)

- Managed TMS (49)

- News (38)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (121)

- Warehousing & Distribution (49)