September 17, 2021

The purpose of this weekly update is to provide shippers with the latest intermodal shipping news that is impacting freight capacity and service across both the US truckload and intermodal markets.

INTERMODAL RAMP UPDATES

Union Pacific

Macro Update:

Macro Update:

Temporarily reduced gate reservations in specific, targeted lanes remain in place to help balance the UP intermodal network. The best estimate given is the below lanes will be metered through the end of September, with the top priority during this metered phase is to protect MCP committed business. It is highly unlikely that UP will be supporting any transactional freight during this time (SCQ and DMQ volume).

ITR Temporarily Adjusted Lanes:

- G2 to Brooklyn

- G2 to Lathrop

- G2 to Salt Lake City

- G2 to Tacsim

- G2 to Sparks

- SLC to Marion

- Seattle to Marion

- Kansas City to Lathrop

- Kansas City to Portland

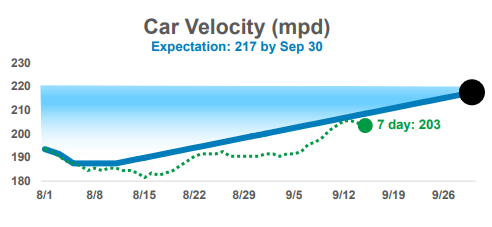

A key measurement the UP uses to measure its intermodal network health is car velocity (car miles per day). The goal is to get network velocity up to 217 mpd by the end of September. As of today, they are at 203.

Equipment Update by Ramp:

- LA: Supply was better this week than originally anticipated. Next week, the expectation is for supply to be a little tighter than this week.

- Dallas/SAIT/Houston: The current granting hold will continue through next week. Aggregate surge begins in Dallas and Houston next week, with the hope that this will produce more street turns for committed capacity.

- Lathrop: While capacity remains adequate to meet MCP demand, expecting challenges in the coming weeks as demand is increasing out of this metro.

- Portland: Granting is unlikely for non-MCP contracts in Portland next week, as they work to drive capacity to committed customers. As demand increases, it is less likely they will be able to supply grants above baseloads.

- Laredo/STIR: Very limited supply. It is unlikely MCP demand will be filled out of these metros next week.

- Mexico: Monterrey experienced some improvement in capacity this week. Next week will be lower unless there is additional CSX interchange, which if it happens will all be directed to Mexico.

- Marion: A chassis shortage is currently impacting capacity. Operations is working to reposition additional chassis into the market, although much slower than we’d all like. Only supply at this time is currently coming from empty ingates.

- To add to the above chassis shortage, some outbound Marion lanes have fallen under a pullback strategy to improve overall intermodal network service. So, for now, the "less will be more in the future" strategy has impacted the ability to provide service in selected lanes. Two lanes we know that has impacted many include: Marion to SLC and Marion to Portland.

- The expectation is this strategy will be in place for the next two weeks.

-

NS Updates

Domestic intermodal ingate restrictions have been lifted as chassis repairs are near completion.

CSX Updates

Nothing new to report.

BNSF Updates

Nothing new to report.

Tropical Storm Nicholas

Intermodal operations in the Houston area still being serviced, although there are some service delays as the operations monitors track conditions caused by flooding.

Expectation is the slowing moving nature of Tropical Storm Nicholas will challenge New Orleans market for the next few days.

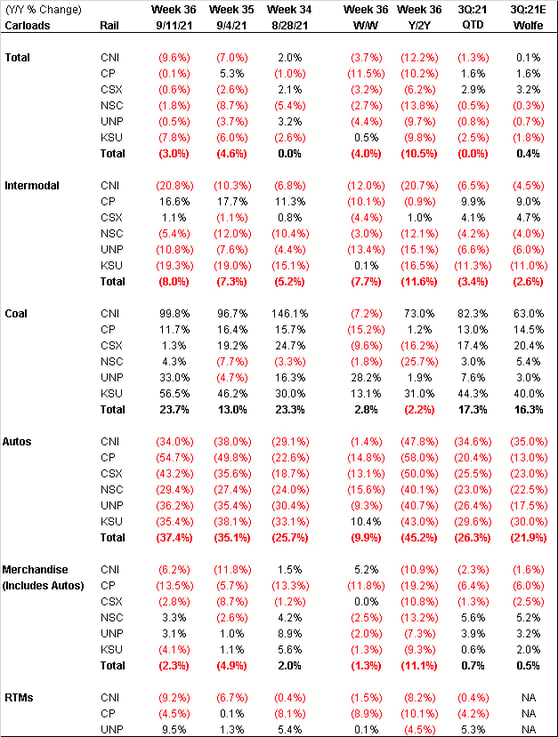

Class I Railroad Performance Indicators

More on InTek Freight & Logistics Services