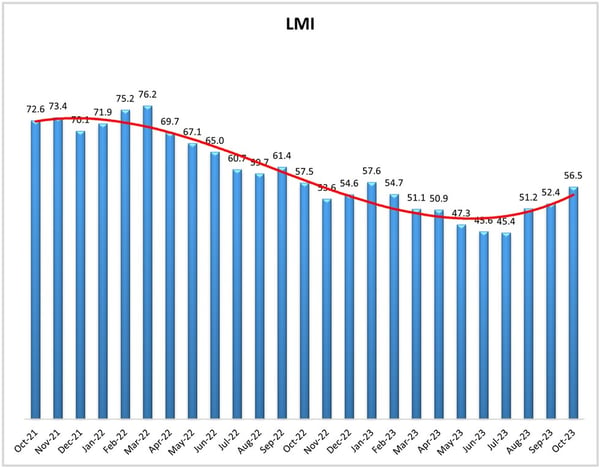

As the old saying goes, two is a coincidence, three is a trend. After a stretch of three straight all-time lows, the October Logistics Managers' Index (LMI) marks three in a row in the black, climbing to the fastest rate of expansion since January with a reading of 56.5 (up 4.1 from September). That figure is high enough to compare reasonably well to last October's LMI of 57.5 and suggests the market may be climbing from the doldrums.

The sub-metrics most responsible for last month's growth are Inventory Levels, Inventory Costs, Warehousing Utilization, and Transportation Utilization - all of which saw significant gains ranging from 5.2 to 7.2. The six point increase for Inventory Levels pulled it from contraction (47.4) into expansion (53.4) for the first time in six months, suggesting shippers may be loading up for more consumer activity - a sign (along with the other positives) authors say is a "marked step forward for the logistics industry."

Getting back to Transportation Utilization, that metric passed the 60 threshold for the first time in 13 months, while its counterpart Transportation Capacity fell below 60 for the first time since April of 2022 - falling 7.7 from September. Transportation Prices is the only metric still in contraction territory, but that contraction is slowing with an October reading of 44.4, up 0.9 from the month prior.

Authors stress the need for equilibrium between supply and demand to get the freight market back on solid footing, and while the inventory growth is a positive indicator, demand is still lagging supply. That means exiting capacity is the other method to balance, and Yellow's shutdown along with that of Convoy have certainly contributed to upticks in volume for former competitors. And some experts predict there may be more exits before all is said and done.

Significantly, the numbers suggest warehousing will avoid the same kind of pain seen by its transportation counterparts in the logistics industry, with continued growth anticipated without ever having dropped into a recessionary stance. Overall, survey respondents continue to show optimism for the market over the next year, predicting an LMI reading of 60.8 in 12 months, a number that's also gone up three straight months.

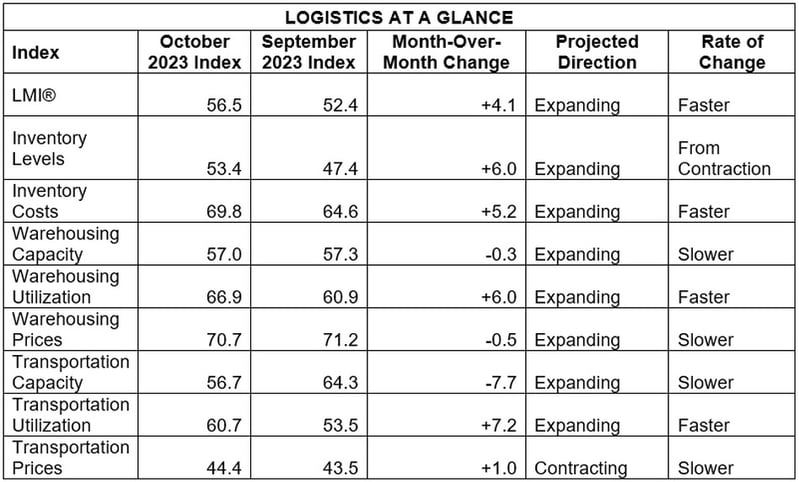

By the Numbers

See the summary of the October 2023 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in October 2023.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry. Or start with these links below: