Shippers all across the US are struggling to meet the demands their supply chains are requiring to bring products from the western port cities to the interior of the US to meet their consumer orders.

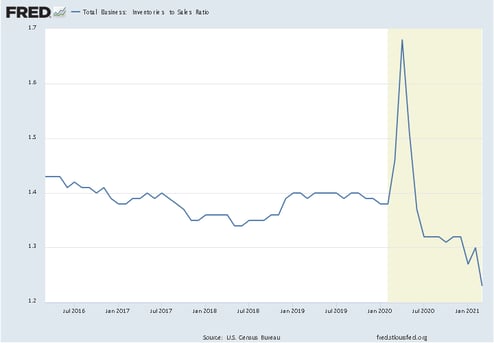

There are numerous reasons for the freight capacity shortage. Many can be traced back to the effects of buying patterns, types of products being bought, and inventory levels not set appropriately to address the changes brought on by the COVID-19 pandemic.

The purpose of this article is not to go too far into the factors causing the freight capacity crunch that I honestly have not seen in my 30 plus year career in managing logistics and supply chains, as either a shipper or third-party logistics company.

Instead, we are here to share the operational side of the effects to the freight market that the pandemic caused, then provide solutions to address the various problems that appear poised to worsen through the next few months.

Why the Chicago Freight Market is Capacity Constrained

To start, Chicago is the largest inland port and gateway between the East (CSX & Norfolk Southern) and West (BNSF & Union Pacific) Class I Railroads. The 19 intermodal rail ramps not only are the handoff point for many of the high volume Eastbound and Westbound intermodal freight, but they also serve as the intermodal ramp for the 300 mile radius of Chicago that represents roughly 15% of the US population.

As a result of being the crossroads of the Westbound to Eastbound intermodal traffic, Chicago takes the brunt of the volume surges that are driven from imports coming into all the US West Coast ports.

At times, the massive amounts of freight can be advantageous for intermodal shippers where they are able to take advantage of the imbalance of intermodal boxes and obtain backhaul rates from their IMC’s (intermodal providers), but in extremely tight freight markets the volume simply overtakes the city. The result is the landlocked intermodal ramps have no other choice but to shut ingates down for a period of time to clear space to normalize operations.

Adding to it is dray carriers choose to move their equipment to over-the-road freight lanes that have higher profit potential in capacity constrained markets, which further deteriorates intermodal service and raises prices across both truckload and intermodal.

With the background in place, let’s take a look at the current situation shippers are having to work through in the Chicago freight market and how they can better position their company to be successful in this competitive freight market.

Why Truckload Freight is Capacity Constrained in Chicago

While the majority of the previous discussion centered around intermodal, according to DAT the Chicago market is one of the top 10 truckload, reefer and flatbed freight markets every year.

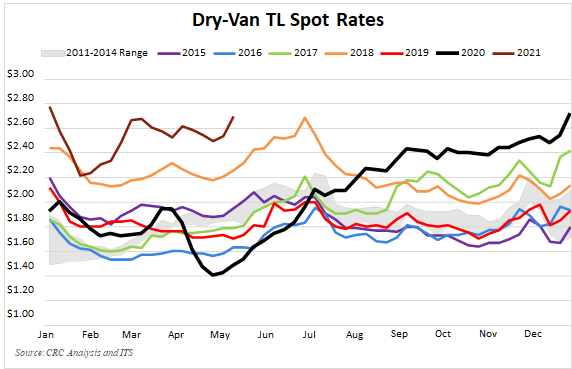

With that said, Chicago experiences the full effects of a capacity constrained freight truckload market. The constrained conditions have been in play for the last 9 months and according to freight analysts the trend is here to stay through the end of the year.

Why Intermodal is Capacity Constrained in Chicago

Domestic intermodal, which was the initial relief valve for many shippers, is now under the same capacity constraints found in the truckload market and now have multiple operational issues that are limiting the intermodal options available to shippers.

Domestic intermodal, which was the initial relief valve for many shippers, is now under the same capacity constraints found in the truckload market and now have multiple operational issues that are limiting the intermodal options available to shippers.

Below is an outline of the problems and as you walk through them know that any one or more can be of issue on any given day.

- Major Congestion

- As a result of the congestion, railroads are changing ingate ramps which are then impacting lane transit times.

- BNSF & Union Pacific running out of space to manage the container traffic within its Chicago inland intermodal ramps.

- Limited Gate Reservations

- Chassis Shortage

- Dray Constraints

- Dray carriers picking and choosing the freight loads that work best for their network of customers.

- As a result of the above, the one-way intermodal markets out of Chicago are even more capacity challenged.

- Dray carriers picking and choosing the freight loads that work best for their network of customers.

Options Shippers Have to Alleviate Their Freight Capacity Challenges with Outbound Chicago Freight

In the next few paragraphs, I’ll share the options shippers have to improve their odds of finding 53’ capacity options for their companies, whether that is truckload or intermodal.

-

Drop Pools vs Live Loads

-

Window Appts vs Specific Appts

-

TOFC

-

You may think all closed, but it is more lane specific

-

Be Flexible on The Day

Trailer and Container Drop Pools

Trailer and Container Drop Pools

Providing drop trailer or container options for freight carriers allows them to better manage their most valuable assets, their drivers, to the fullest possible extent. Giving drivers more time in their day to move more freight versus sitting to be loaded or unloaded will put more dollars in the driver’s pocket and be a place freight carriers will want to send in their equipment.

Use Window Appts vs Specific Appts

Suppose drop pools are not an option for your facility because of space. In that case, the next best option for your facility is to give freight providers appointment windows to be loaded or unloaded versus specific dock times.

Again, this suggestion has to do with giving the most flexibility to the drivers moving your company’s freight to maximize their time moving loads versus sitting at customer docks.

Listen to Your Current Pool of Trusted Freight Providers

Your trusted motor carriers and freight brokers are in the market every day for your business and the business of others. This gives them a tremendous amount of first-hand information that helps them best serve your business with the most up to date information on where capacity can be found at the best possible price, and not only is the information invaluable, but it is free.

Be Flexible on the Pick-Up Day

We’ve seen the ability to exercise flexibility on either the pick-up or delivery day can be the difference between finding service on your freight lane and reducing your freight costs by 20% or more.

Use TOFC Intermodal

Quite often, when shippers struggle with their 53’ OTR truckload capacity, they look to freight brokers and to 53’ COFC (container-on-flatcar) intermodal.

Quite often, when shippers struggle with their 53’ OTR truckload capacity, they look to freight brokers and to 53’ COFC (container-on-flatcar) intermodal.

The often overlooked 53’ freight capacity option is TOFC (trailer-on-flatcar) intermodal service.

In a constrained freight capacity market, TOFC is a perfect option because of the following characteristics:

-

Faster Transit than COFC Intermodal Service

-

Spot Market Pricing is Between Truckload & COFC Intermodal

-

Does Not Require Gate Reservations

-

Does Not Require an Intermodal Chassis

Not All Outbound Freight Lanes Are Closed in a Given Market

The topic of lanes being closed to service is one that 53’ COFC domestic intermodal shippers sometimes run into because of weather or extreme freight capacity situations.

The point here is that intermodal is managed by ramp pairings, meaning origin and destination railroad intermodal ramps are managed to the goal of equal amount of inbound intermodal containers to an equal amount of outbound intermodal containers.

So, if a shipper hears a ramp is closed, it is worth exploring that comment further to find the origin-destination (O-D) pairings that are not being serviced because it is often not the case where all O-D pairings are closed unless the railroad has announced they are not accepting any intermodal ingates to the intermodal ramp.

Next Steps

While the six previously mentioned steps companies can take to help their freight capacity challenges, they will not solve all issues but they will put businesses in a better position to succeed. The added bonus is all six actions are controllable by companies themselves and not reactionary steps that the market ultimately controls.

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Below is a small sample of our more in-depth papers on key topics shippers have found useful in managing through their freight and logistics challenges that you too may find helpful:

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (54)

- Freight Broker (60)

- Freight Forwarder (2)

- Intermodal Transportation (184)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (420)

- Logistics Service Provider (77)

- LTL (39)

- Managed TMS (49)

- News (39)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (122)

- Warehousing & Distribution (50)