If you are struggling to find outbound freight capacity from Los Angeles, you are not alone.

Shippers all across the US are struggling to meet the demands their supply chains are requiring to bring products from the western port cities to the interior of the US to meet their consumer orders.

There are numerous reasons for the freight capacity shortage. Many can be traced back to the effects of buying patterns, types of products being bought, and inventory levels not set appropriately to address the changes brought on by the COVID-19 pandemic.

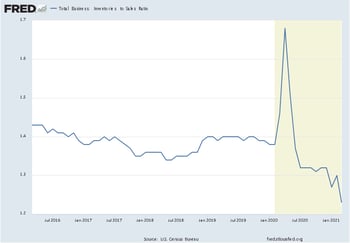

The inventory-to-sales ratio graph illustrates just how far behind shippers are in pushing their inventory levels to "normal" level to meet consumer demand.

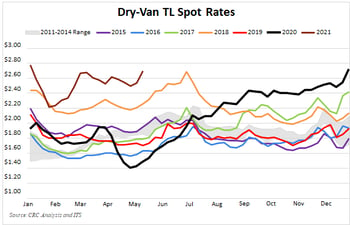

Compare the above chart to how the demand for trucks has pushed the truckload spot rates to historical highs with shippers demands much greater than total freight capacity available.

While we just dropped into the weeds a bit on why the incredibly constrained freight market is expected to remain in place for the foreseeable future, the purpose of this article is not to go too far into the factors causing the freight capacity crunch that I honestly have not seen in my 30 plus year career in managing logistics and supply chains, as either a shipper or third-party logistics company.

Instead, we are here to share the operational side of the effects to the freight market that the pandemic caused, then provide solutions to address the various problems that appear poised to worsen through the next few months.

Why SoCal and NorCal Freight Markets Are Capacity Constrained

To start, the SoCal and NorCal outbound freight markets are two of the top five worst regions for the following reasons:

Reasons Truckload Freight is Capacity Constrained in Los Angeles

Reasons Truckload Freight is Capacity Constrained in Los Angeles

- Competition for capacity is strong with the produce season in full swing at a time when imports to SoCal and NorCal are at all-time highs. Shippers can expect the situation to worsen with importers drawing products into the US market sooner rather than later to improve their odds for making the trans-Pacific slots assigned to the various ocean carriers.

- The supply chain problem for the Pacific-Rim countries, particularly China, is they don’t have enough truck capacity or containers to even get the product from the manufacturing sites to the port. In some cases, the delays are reaching up to 5 weeks.

- The supply chain problem for the Pacific-Rim countries, particularly China, is they don’t have enough truck capacity or containers to even get the product from the manufacturing sites to the port. In some cases, the delays are reaching up to 5 weeks.

Reasons Intermodal Freight is Capacity Constrained in Los Angeles

Domestic intermodal, which was the initial relief valve for many shippers, is now under the same capacity constraints found in the truckload market and now has multiple operational issues that are limiting the intermodal options available to shippers.

Below is an outline of the problems. As you walk through them, know that any one or more can be an issue on any given day.

Dray Constraints

Dray Constraints

- Dray carriers are taking the easy and best-paying lanes to optimize their operating ratios and profits. Shippers can help themselves by setting their operations to accommodate the following:

- Drop and Swap

- First Come First Serve (FCFS)

- No Appointment Loads

- Short Miles

- Dray carriers are taking the easy and best-paying lanes to optimize their operating ratios and profits. Shippers can help themselves by setting their operations to accommodate the following:

- Gate Reservation Restrictions

- Los Angeles, CA to Chicago, IL is extremely difficult to obtain if a shipper is not already operating under a MCP (mutual commitment program) through the Union Pacific (UP).

- UP placing additional surcharges to every intermodal box a shipper ingates that is in excess of its MCP volumes.

- Intermodal rail dray is competing with dray opportunities associated with the port.

Options Shippers Have to Alleviate Their Freight Capacity Challenges with Outbound California Freight

In the next few paragraphs, I’ll share the options shippers have to improve their odds of finding 53’ capacity options for their companies, whether that is truckload or intermodal.

- Drop Pools vs Live Loads

- Window Appts vs Specific Appts

- TOFC

- You may think all closed, but it is more lane specific

- Be Flexible on The Day

Trailer and Container Drop Pools

Trailer and Container Drop Pools

Providing drop trailer or container options for freight carriers allows them to better manage their most valuable assets, their drivers, to the fullest possible extent. Giving drivers more time in their day to move more freight versus sitting to be loaded or unloaded will put more dollars in the driver’s pocket and be a place freight carriers will want to send in their equipment.

Use Window Appts vs Specific Appts

Suppose drop pools are not an option for your facility because of space. In that case, the next best option for your facility is to give freight providers appointment windows to be loaded or unloaded versus specific dock times.

Again, this suggestion has to do with giving the most flexibility to the drivers moving your company’s freight to maximize their time moving loads versus sitting at customer docks.

Listen to Your Current Pool of Trusted Freight Providers

Your trusted motor carriers and freight brokers are in the market every day for your business and the business of others. This gives them a tremendous amount of first-hand information that helps them best serve your business with the most up to date information on where capacity can be found at the best possible price, and not only is the information invaluable, but it is free.

Be Flexible on the Pick-Up Day

We’ve seen the ability to exercise flexibility on either the pick-up or delivery day can be the difference between finding service on your freight lane and reducing your freight costs by 20% or more.

Use TOFC Intermodal

Quite often, when shippers struggle with their 53’ OTR truckload capacity, they look to freight brokers and to 53’ COFC (container-on-flatcar) intermodal.

Quite often, when shippers struggle with their 53’ OTR truckload capacity, they look to freight brokers and to 53’ COFC (container-on-flatcar) intermodal.

The often overlooked 53’ freight capacity option is TOFC (trailer-on-flatcar) intermodal service.

In a constrained freight capacity market, TOFC is a perfect option because of the following characteristics:

- Faster Transit than COFC Intermodal Service

- Spot Market Pricing is Between Truckload & COFC Intermodal

- Does Not Require Gate Reservations

- Does Not Require an Intermodal Chassis

Not All Outbound Freight Lanes Are Closed in a Given Market

The topic of lanes being closed to service is one that 53’ COFC domestic intermodal shippers sometimes run into because of weather or extreme freight capacity situations.

The point here is that intermodal is managed by ramp pairings, meaning origin and destination railroad intermodal ramps are managed to the goal of equal amount of inbound intermodal containers to an equal amount of outbound intermodal containers.

So, if a shipper hears a ramp is closed, it is worth exploring that comment further to find the origin-destination (O-D) pairings that are not being serviced because it is often not the case where all O-D pairings are closed unless the railroad has announced they are not accepting any intermodal ingates to the intermodal ramp.

Next Steps

While the six previously mentioned steps companies can take to help their freight capacity challenges, they will not solve all issues but they will put businesses in a better position to succeed. The added bonus is all six actions are controllable by companies themselves and not reactionary steps that the market ultimately controls.

While the six previously mentioned steps companies can take to help their freight capacity challenges, they will not solve all issues but they will put businesses in a better position to succeed. The added bonus is all six actions are controllable by companies themselves and not reactionary steps that the market ultimately controls.

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Below is a small sample of our more in-depth papers on key topics shippers have found useful in managing through their freight and logistics challenges that you too may find helpful:

- Freight Costs: An Insider’s Look on Freight Pricing Buyers Should Know

- The Complete Guide to Freight Management Service Solutions

- The Complete Guide to Intermodal Transportation

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (54)

- Freight Broker (59)

- Freight Forwarder (2)

- Intermodal Transportation (183)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (418)

- Logistics Service Provider (76)

- LTL (39)

- Managed TMS (49)

- News (39)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (122)

- Warehousing & Distribution (50)