Best Intermodal Shipping Companies & How to Choose the Right One

Domestic intermodal shipping involves moving freight on the ground via a combination of road and rail. Having loads travel via train for the long-haul portion of the journey allows intermodal companies to offer cost and sustainability advantages, while incorporating trucks for the short haul allows for flexible door-to-door delivery.

Top Intermodal Transportation Companies

The top intermodal freight companies - known as intermodal marketing companies (IMCs) - work directly with Class 1 railroads to coordinate rail service. The largest intermodal transportation providers account for the majority of market share and own their containers.

InTek

InTek Freight & Logistics is hardly the biggest IMC, but as a non-asset provider with extensive intermodal expertise, customers realize a number of advantages - with service being the key. InTek's people, relationships with Class I Railroads and trucking companies and technology mean solutions for freight of all kinds, across North America.

Services Provided

- Door-to-door intermodal (domestic and cross-border)

- Truckload brokerage services

- Transloading

- Managed transportation

- Refrigerated freight

Strengths

- Dedicated, white-glove type customer service with every account having its own Ops Manager

- Non-asset intermodal provider with flexibility to use both private and public containers, along with direct relationships with all North American railroads

- Competitively priced intermodal services that can also include 40' box programs

Weaknesses

- Not a one-off spot shipment shop that is narrowly focused on intermodal - emphasizing long-term relationships

- Very well known among intermodal providers, but not well known to potential intermodal shippers

JB Hunt

With 60 years of industry experience, J.B. Hunt has grown from five trucks and seven trailers to a Fortune 500 company listed on the NASDAQ with roughly a $17.5 billion market cap providing a variety of services for customers throughout the continental United States, Canada, and Mexico - placing it among the leading intermodal shipping companies.

Services Provided

- Door-to-door intermodal (domestic and cross-border)

- Asset truckload and truckload brokerage services

- Managed transportation

- Transloading

- Refrigerated freight

Strengths

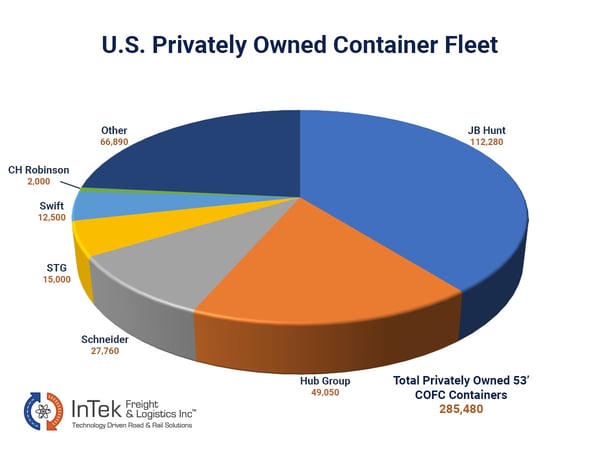

- Considered the intermodal market leader with the largest fleet of company-owned domestic intermodal containers

- Large company owned drayage driver fleet

- Very competitive pricing on key intermodal lanes

Weaknesses

- May be too large for small to mid-size businesses

- Less flexibility for lanes outside their dedicated map

Hub Group

With over 50 years of experience in the industry, Hub Group is another of the largest intermodal transportation companies, offering service across North America. More than 6,000 employees serve and support the company's asset-based intermodal program. Hub Group is listed on NASDAQ with roughly $2.5 billion in market cap.

Services Provided

- Door-to-door intermodal (domestic and cross-border)

- Asset truckload and truckload brokerage services

- Managed transportation

- Transloading

- Refrigerated freight

Strengths

- Owns about 50,000 containers, second only to JB Hunt in the U.S.

- Nationwide drayage network covering 29 terminals with dedicated drivers

- Competitively priced

Weaknesses

- Customer service tends to rate below smaller, non-asset providers

- Most shippers consider as a secondary or tertiary provider behind JB Hunt

Schneider National

Among the oldest freight providers in the U.S., Schneider National was founded in 1935 and now boasts a variety of transportation services. In addition to its substantial container fleet, it is among the largest intermodal trucking companies and is listed on the New York Stock Exchange with a market cap of almost $4.0 billion.

Services Provided

- Door-to-door intermodal (domestic and cross-border)

- Asset truckload and truckload brokerage services

- Managed transportation

- Transloading

- Refrigerated freight

Strengths

- Third-largest asset IMC with more than 27,000 containers

- Competitively priced

- Flexibility in asset and non-asset drayage capacity

Weaknesses

- Customer service ratings vary, with larger companies tending to feel better served than smaller ones

- Tends to rank second or lower among shippers' provider options

STG Logistics

Founded in 1985 as a warehousing firm, STG Logistics now operates coast-to-coast across North America, offering port-to-door supply chain solutions. STG became one of the top intermodal logistics companies in the U.S. when it acquired XPO Logistics' intermodal operations in 2022.

Services Provided

- Door-to-door intermodal (domestic and cross-border)

- Truckload brokerage services

- Managed transportation

- Transloading

- Refrigerated freight

Strengths

- Fleet of 15,000 containers makes it the 4th largest asset IMC

- Largest national drayage network in North America

- Competitively priced by leveraging largest port-to-door services through company assets, transloading and technology

Weaknesses

- Still transitioning customers and service related to XPO acquisition across their entire service offering

- Working to grow market share and notoriety in the IMC marketplace

Swift Transportation (a part of Knight-Swift)

Thanks to its merger with Knight (to form Knight-Swift), Swift Transportation considers itself America's largest full truckload carrier. Since its founding in the 1960s, Swift has also grown to be among the top five intermodal transport companies in the country. Traded on the New York stock exchange with a market cap of roughly $8.0 million.

Services Provided

- Door-to-door intermodal (domestic and cross-border)

- Asset truckload and truckload brokerage services

- Managed transportation

- Transloading

- Refrigerated freight

Strengths

- More than 12,000 privately owned containers

- Flexibility in asset and non-asset drayage capacity

- Separate terminal network located near rail gates

Weaknesses

- Significantly fewer assets than top three asset IMC companies

- Pricing is competitive, but tends to be a bit higher according to customer ratings

Who is the largest intermodal carrier?

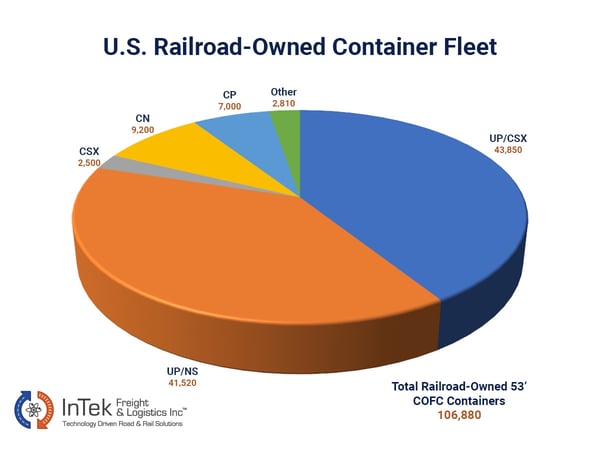

Determining the largest intermodal carrier is simple when looking at the number of assets each of the top companies owns. The charts below breakdown the container ownership of asset-based intermodal shipping companies and class 1 railroads. Though not owners, non-asset IMCs like InTek can tap into most of this capacity.

Types of intermodal transportation companies

Intermodal transportation companies are logistics providers that purchase intermodal capacity directly from railroads and trucking firms to give shippers door-to-door service. There are two types of intermodal companies - better known within the industry as intermodal marketing companies or IMCs - bi-modal and non-asset.

Intermodal marketing companies

Intermodal marketing companies exist because U.S. class 1 railroads do not sell intermodal direct. IMCs handle sales, coordination and communication - serving as a single customer point of contact and biller.

Bi-modal intermodal marketing companies

Bi-modal intermodal marketing companies own most containers and dray trucks they use when handling an intermodal freight move. Examples include J.B. Hunt, Hub Group and others making up the largest IMCs.

Non-asset IMCs

Non-asset IMCs perform the same function as bi-modal companies, but they use railroad and privately owned containers and coordinate truck segments with private dray carriers. Examples include InTek and other companies of various sizes.

How to choose the best intermodal company

Now that you are armed with the basic information, there are a few important considerations for your business to additionally work through as you choose among the best intermodal shipping companies.

1. Customer base

Does the IMC typically work with large, high-volume shippers or are their intermodal services geared toward small to medium-sized shippers? Consider which one reflects your business as you decide the best fit.

2. Service

Service covers the speed and reliability of delivery and how the company handles areas like dray activities, the execution of loads, adaptability to issues and visibility throughout the journey.

3. Communication

Communication is key within the intermodal provider, between the provider and the railroad(s) and dray provider(s), and between the provider and you, the customer.

4. Dedicated operational support

Consider whether your company will have a dedicated point of contact handling your shipments or go into a pool of customers passed around a call center.

5. Price

It would be disingenuous to leave out price as a consideration, as while pricing can be fairly standardized, there are variations - and every little bit helps your bottom line. Just remember, it shouldn't be the only factor.

6. Subject matter expertise

Does the IMC know what it's doing inside and out? Evidence of subject matter expertise includes blogs, articles, videos and other forms of thought leadership and knowledge-sharing.

7. Certifications and validation

In addition to sharing knowledge, look for independent certifications from the industry and a presence in major intermodal and transportation-related organizations.

8. Technology

Whether its route and rate optimization, shipment track and trace, transportation management system (TMS) software or other technology, ensure your IMC of choice is on top of it all.

9. Asset ownership

While the largest providers own the majority of the assets they use, no intermodal company owns them all - and they all have to use the same railroads. Consider how important ownership is to you.

10. Freight brokers

Technically, freight brokers can sell intermodal service. But consider that they must use an IMC to do so, meaning there is additional margin built into the cost - and an additional layer to follow (and adjust) the shipment.

Choose InTek for a creative solution to your intermodal needs

InTek addresses many of the key considerations above, with proven intermodal expertise, service reliability and a dedicated operations pro handling each customer's shipping needs - meaning no freight shipper is too big or small.

Our partnerships with all class 1 railroads and relationships with private container owners (including some of the bi-modal companies in this piece) and dray providers make handling any shipping challenge possible. Just reach out to us to learn more.

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (40)

- Freight Broker (57)

- Freight Forwarder (2)

- Intermodal Transportation (162)

- International & Cross Border Logistics (35)

- Logistics & Supply Chain (355)

- Logistics Service Provider (74)

- LTL (38)

- Managed TMS (48)

- News (26)

- Supply Chain Sustainability (10)

- Transportation Management System (37)

- Truckload (110)

- Warehousing & Distribution (40)