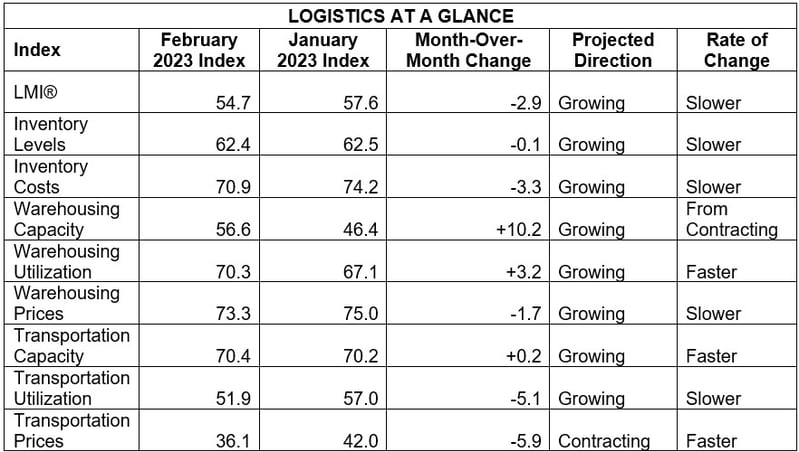

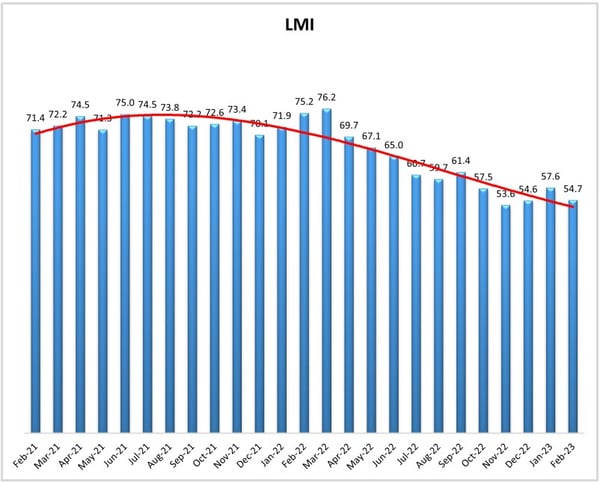

After two straight months of increases, February's Logistics Managers' Index (LMI) was back down, with the culprit largely traceable to a noticeable drop in Transportation Prices. In fact, the Transportation Prices measure is contracting at the fastest rate in the 6.5 year history of the LMI, with an index figure of 36.1 after a 5.9 point month-to-month drop. Relatedly, Transportation Utilization was down 5.1 from January as well (though it does remain above the 50 point growth threshold at 51.9). The overall LMI registered at 54.7 in February, off 2.9 from the year's first month. So why the monthly declines? Index authors suggest January's prices remained higher due to some catchup from a December backlog caused by severe winter weather. Additionally, February is generally considered a seasonal low point with lower consumer spending after the holiday season as well as a break in imports due to Lunar New Year closures. On the other hand, authors say some survey respondents are optimistic that the year's second quarter will see a traffic rebound as retail inventories rebuild heading toward the traditional peak season - though that is no sure thing. In other highlights, Warehousing Capacity shot up with a 10.2 point increase over January to 56.6, marking its first move into the "growing" category in 2.5 years. This means there is more warehouse space available, even though Warehouse Utilization increased 3.2 points to 70.3. Costs relating to storage haven't caught up yet, as Warehousing Prices stand at 73.3 after just a 1.7 point decline and Inventory Costs remain at 70.9 with a slightly larger drop of 3.3 month to month. The index authors say strong growth in Warehouse Capacity will need to continue for a longer period to bring those prices down. While January's numbers suggested a waking up of supply chains, that appears to be further in the future, though authors do believe the low in Transportation Prices recorded in February may signal a bottom, from which things can only go up.

By the Numbers

See the summary of the February 2023 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in February 2023.

Need assistance with your shipping operation? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry. Or start with these links below: