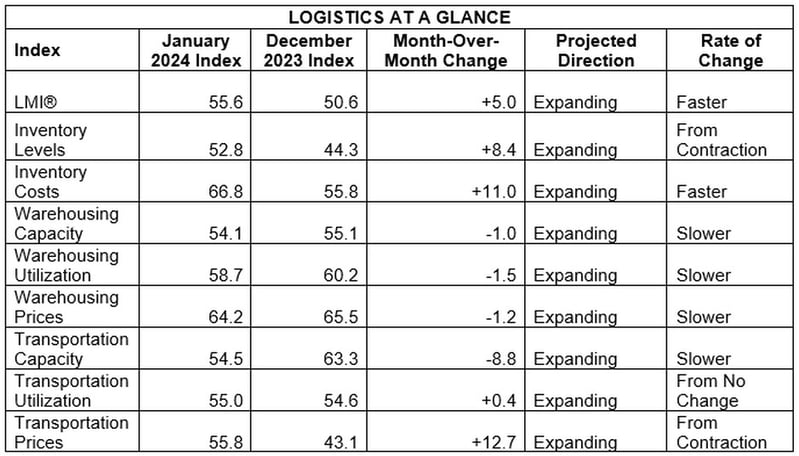

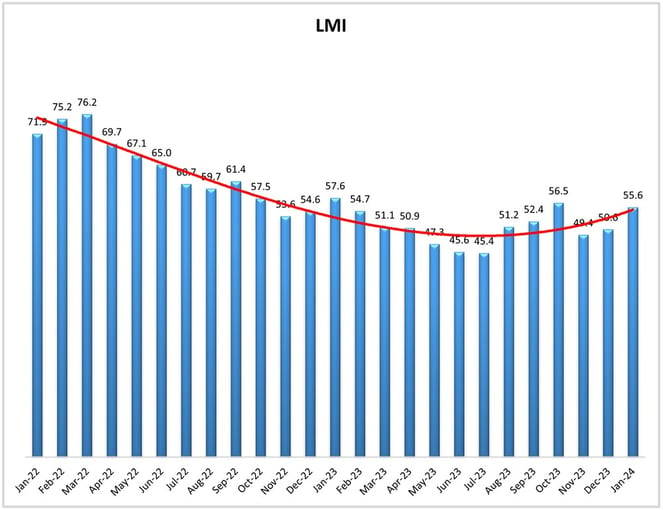

Transportation Prices, a metric mired in contraction for nearly two years, moved into expansion in January's Logistics Managers' Index (LMI). Prices on the transportation side gained a whopping 12.7 from December, to go from contracting across the 50 threshold to 55.8. In fact, for the first time since September of 2019, all eight LMI metrics are expanding - with the overall index reading at 55.6.

Why did Transportation Prices shoot up? LMI authors say it's due to retail restocking following the holiday season. That idea is supported by movement on inventory metrics as well, with Inventory Costs rising by 11 points to 66.8, and Inventory Levels also moving from contraction to expansion (+8.4) at 52.8. Also related, Transportation Capacity fell 8.8 to 54.5, meaning demand caused by the inventory movement led to higher prices and lower capacity.

Transportation Utilization stayed steady, up 0.4 to 55.0. Notably, prices moved ahead of capacity. Authors say when the two metrics have inverted in the past, it has signaled a market shift. But utilization is worth watching as well, since it did not grow to a degree matching the movement of prices and capacity.

On the warehousing side, consistency was the name of the game. Warehousing Prices, Utilization and Capacity all ticked down between 1 to 1.5 points, but all remained in expansion at 64.2 for prices, 58.7 for utilization and 54.1 for capacity. Those numbers all indicate "steady, sustainable rates of expansion" according to authors. The across-the-board positivity is certainly a good sign for the freight market as a whole, but LMI authors caution that calling the end of the freight recession requires more sustained growth over a period of time.

A good omen for sustainable growth is the attitude of those who might purchase some of that retail merchandise. Consumer sentiment figures show Americans are in more of a buying mood, with the University of Michigan survey showing a 10-point jump from December to January, and last month's 79 reading coming in about 15 points higher than January 2023. The Federal Reserve also indicated interest rates may come down over the course of the year, though a spring cut now looks unlikely.

The January report had optimism to spare for the future as well. Asked to predict the future of the LMI, survey respondents' positivity grew again from December, as they expect the LMI to stand at 62.8 in 12 months - which would exceed the all-time average of the index by 0.4 and signal healthy expansion and a growth stance for the freight market.

By the Numbers

See the summary of the January 2024 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in January 2024.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry. Or start with these links below: