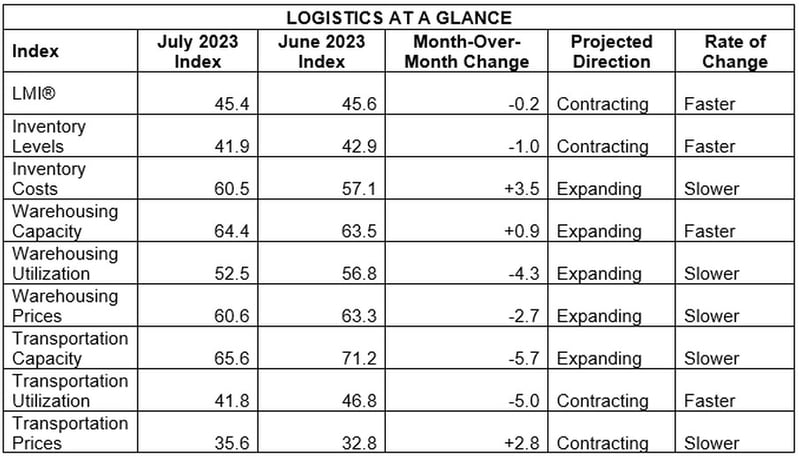

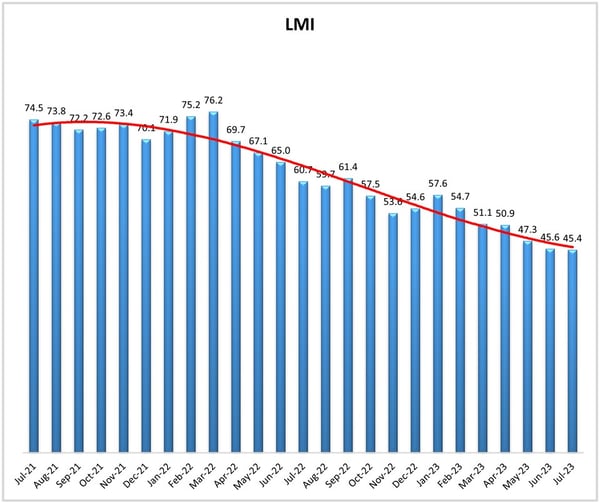

The Logistics Managers' Index (LMI) continued its slide in July, showing an industry in contraction territory for the third straight month. While the slide from June to July was a small one - 0.2 - the 45.4 reading still marks another all-time low, continuing a string of five months in a row of re-setting the record. The biggest drops by index component from June to July were Transportation Capacity at -5.7 and Transportation Utilization at -5.0.

While Transportation Capacity is still the highest value metric at 65.6, that change shows slowing growth, while the Transportation Utilization figure fell further into contraction at 41.8. Transportation Prices slowed their rate of contraction, gaining 2.8 in July to 35.6 (still the lowest figure of all individual measures). Diving deeper into the month shows a sign of potential life in the freight market, as Transportation Prices were up 11.5 points and Transportation Utilization was up 11.6 over the second half of July - something LMI authors consider statistically significant and a potential first step toward transportation recovery.

For other measures, Inventory Levels fell another point after a 6.5 point drop in June, keeping them in contraction at 41.9, while Inventory Costs last month went up 3.5, to 60.5. Warehousing Capacity was up 0.9, up to its highest level ever at 64.4. There is some thought, according to authors, that inventory right-sizing is about here, and that more seasonal patterns could return soon (though just when is still up for debate). As far as the overall outlook from respondents, the 12-month from now LMI prediction came in at 52.8, the second straight month logistics pros are expecting the index (and thus the market) a year from now to be back in the growing category - though this figure is down 2.6 from last month's prediction.

By the Numbers

See the summary of the July 2023 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in July 2023.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry. Or start with these links below: