The truckload marketplace is a highly fragmented market with 700,000 motor carrier companies, with 91.0% operating 6 or fewer trucks and 97.3% operating fewer than 20 trucks.

Conversely, 53' domestic intermodal has a handful of majors, with maybe another 25 to 30 "real" contenders operating in the 53' domestic intermodal space.

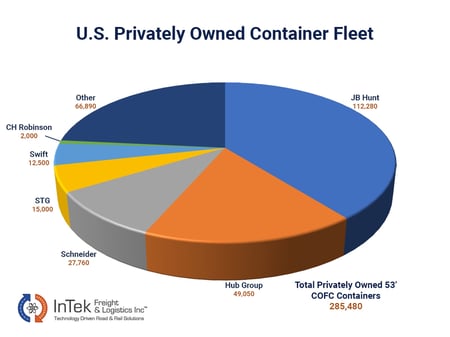

To continue, not all IMC's (intermodal marketing companies) have the ability to access the entire fleet of 53 'containers. Also, not all IMC's tap into the ISO re-positioning market for additional capacity found with 20' and 40' ISO containers, which is in addition to the container fleets listed below.

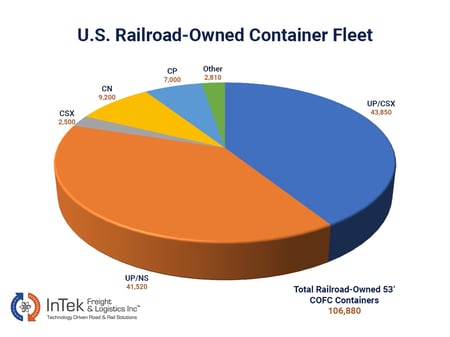

The total number of domestic private and rail-owned 53' dry intermodal containers currently stands at 392,360. The BNSF railroad does not own containers, making this railroad essentially the private box owner railroad. JB Hunt, Schneider, Swift and a few smaller private fleets operate on the BNSF network. This also makes it easier for shippers to identify with these brands and access their capacity, as demonstrated in the article The Best Intermodal Companies (And How To Choose).

The Union Pacific, Norfolk Southern and CSX own containers that move across all three networks through either steel wheel or rubber tire interchanges between the different Class I railroad ramps to traverse North America. These railroads own their own boxes in the EMP and UMAX containers, but they also run the Hub and XPO private owned containers.

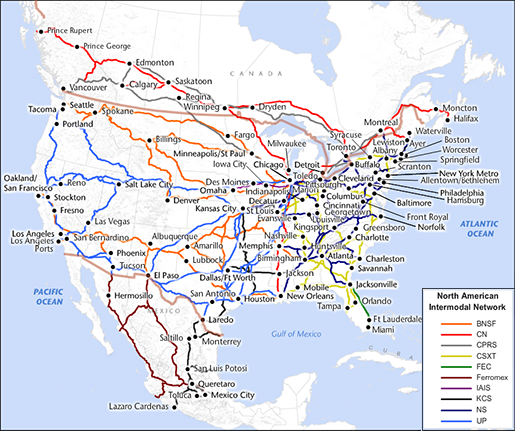

The importance of understanding the box ownership and the railroad network the boxes operate within answers the questions of capacity, pricing and transit. There are a number of examples on all three topics, but for the brevity of this blog will share just a couple.

Companies, such as InTek Freight & Logistics and SunteckTTS, are non-asset IMCs that access all boxes under the Total Box Fleet chart through their direct relationships with the Class I's, private box IMCs and ISO box alliances. There are a number of similar IMCs. Many times Class Is will recommend and introduce a shipper to an IMC when contacted.

An example where routing / railroad network impacts pricing is Salt Lake City. As the intermodal network map below indicates, only the Union Pacific operates an intermodal ramp in the city. Therefore, the UP has a more competitive product for shippers having freight that either originates or terminates in Salt Lake City because of the huge dray advantage it has over other intermodal offerings.

An example on routing for service draws into mind the fires in LA a couple of years ago. The two railroads servicing the market have different rail routings in the city. The result was one Class I Railroad could get in/out of LA, while the other suspended operations until the fires could be controlled near their tracks.

Again, there are several other examples, so do the homework and be sure to include intermodal marketing companies (IMCs) that can support all networks or bring in multiple IMCs that support specific networks to ensure best transit, value and diversification.

For more on information on the topic of 53' domestic intermodal, truckload and managed transportation services, please sign up for our blog.

Also, below are additional blogs to explore further detail on intermodal topics discussed above:

For more on the intermodal industry, we would recommend the Intermodal Association of North America (IANA) website.