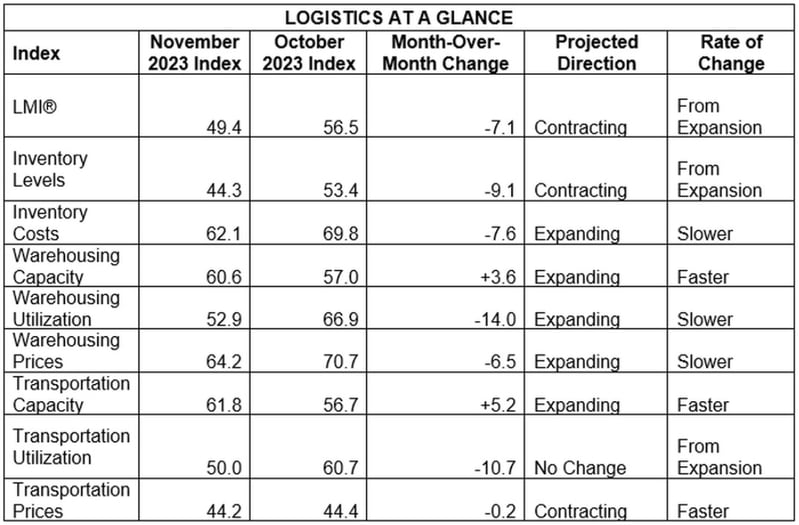

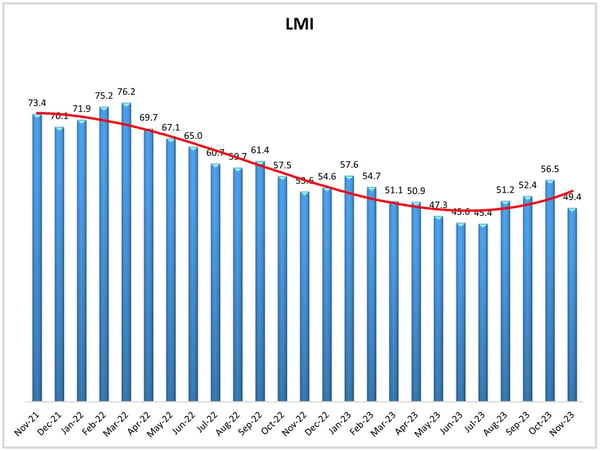

Much as Americans turned their clocks back an hour in early November, the freight market had its own "fall back" last month. The November Logistics Managers' Index (LMI) dropped 7.1, falling out of expansion and slightly into contraction territory with a reading of 49.1. That figure snaps a three month streak of growth and at the very least taps the brakes on talk of a freight market bounce-back.

LMI authors point out though, that the key reason for the sudden drop - the largest in a single month since April 2022 - is inventory, tied to holiday sales. The metrics back up this assertion, as Inventory Levels fell 9.1 to a contractionary 44.3, and relatedly Warehousing Capacity and Transportation Capacity gained ground (up 3.6 and 5.2 respectively). That all additionally ties into significant drops in Warehousing Utilization and Transportation Utilization (-14 and -10.7).

While that April 2022 drop was also related to inventory, authors note in that case, companies had too much inventory they couldn't sell. But in November's case, inventories are selling off quickly due to the season - a not so alarming sign. In fact, spending this holiday shopping season has shown surprising strength, with a record number of shoppers and $38 billion in sales over Cyber Week, up nearly 8% from last year. Perhaps, as authors suggest, retailers are moving more towards just in time inventory strategies.

Other metrics of note include Transportation Prices, which ticked down slightly (-0.2) for the first time since May to 44.2, still in contraction but also the second highest reading in more than a year. Inventory Costs (-7.6) and Warehousing Prices (-6.5) both fell, though both remain in expansion (62.1 and 64.2).

Survey respondents in November maintained a generally positive outlook for the market 12 months from now, projecting an LMI at 57.4. While that's down 3.4 from last month's prediction (and the first drop-back in three months), it would still indicate an expanding freight market.

By the Numbers

See the summary of the November 2023 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in November 2023.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry. Or start with these links below: