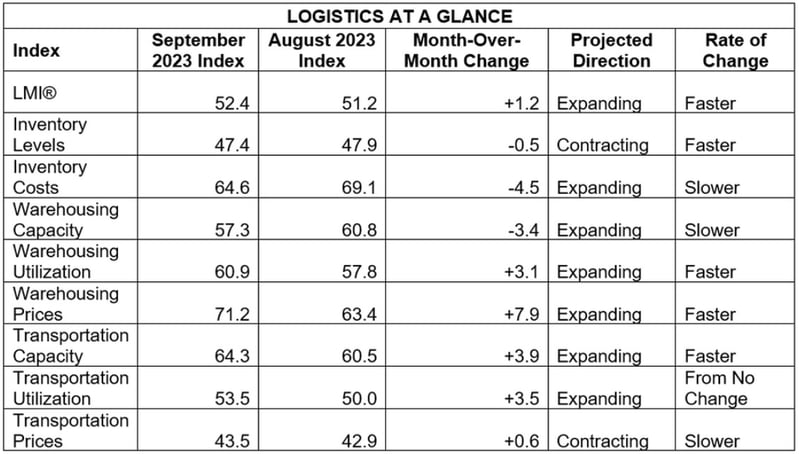

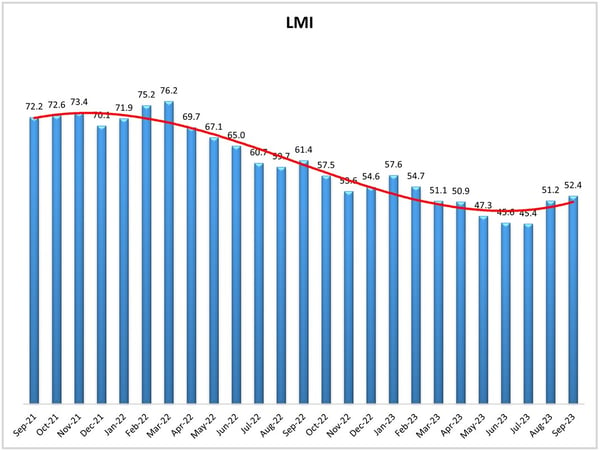

The September Logistics Managers' Index (LMI) suggests an August bounce in the freight market may be more than a one-off, and perhaps the start of an upward trend. For the second straight month, the LMI is showing expansion, with a reading of 52.4 (up 1.2 from August). September's figure marks the fastest rate of expansion since February - though authors note the rate is still quite moderate compared to the LMI average of 62.9.

Still, growth > contraction. What's causing the upward movement? Transportation Utilization was up another 3.5 to move it into expansion at 53.5, while Transportation Prices are still contracting, but at a lower rate again with an increase of 0.6 to 43.5. Transportation Capacity did make gains as well after a drop in August likely related to Yellow's shutdown. It moved +3.9 to 64.3.

Other key metrics that saw gains were in the warehousing space, with Warehousing Prices up 7.9 to 71.2 and Warehousing Utilization up 3.1 to 60.9. Warehousing Capacity meanwhile, dropped 3.4 to 57.3. Inventory Levels were down another 0.5 to continue contracting at 47.4, while Inventory Costs are still in expansion, but at 64.6, -4.5 from August.

The two-month trend back into overall expansion, authors say, suggests we may be seeing a turning point in the logistics industry. There are other economic indicators that back the idea up, as inflation has slowed and personal consumption expenditures were up - and also optimism that Fed rate increases may be over (though that may be unfounded). Headwinds do exist though, with the ongoing (and expanding) UAW strike, the threat of a government shutdown resurfacing in the next couple of months and the resumption of student loan payments.

Still, authors note the last few months of the year are typically better for freight overall, so it would be surprising to see the index drop back into contraction. And respondents' optimism for the next 12 months in the market continued to improve, as they predict the LMI in a year's time will be at 60.1 - the first time that's been the case since July 2022 and up 1.3 from the same metric the prior month.

By the Numbers

See the summary of the September 2023 Logistics Managers' Index, by the numbers:

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in September 2023.

Need assistance with your shipping operations? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Freight Guides to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry. Or start with these links below: