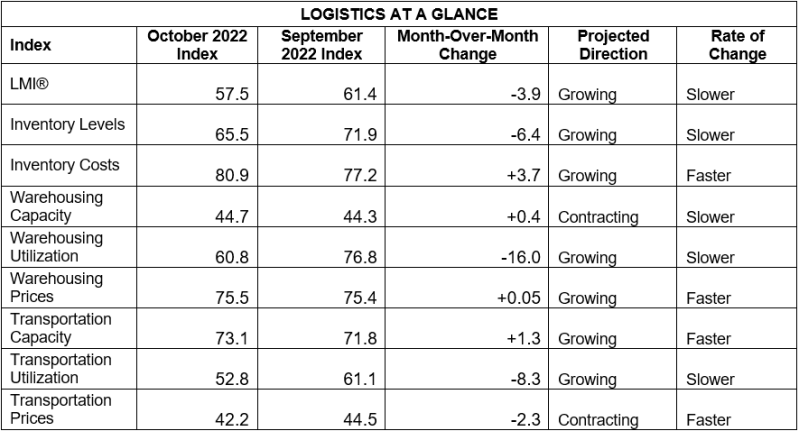

Transportation capacity is at its highest level since the early days of the pandemic while transportation prices are trending down according to the October Logistics Managers' Index (LMI) Report released yesterday. The overall LMI comes in at 57.5 for last month, down 3.9 from September and the second time in three months the figure registered below 60. The latest score is the lowest for the index since May 2020, when COVID-19-related lockdowns were still in force. While it is in the midst of a downward trend over the past six months, the fact that the LMI remains above 50 indicates continued growth - in this case fueled not by transportation capacity but by warehousing and inventory. In those areas, costs remain high (and growing) while warehousing capacity contracts - with inventory growth slowing a bit because companies are making a concerted effort to offload volume. Back to the transportation side, capacity came in at 73.1 in October, signifying the highest growth rate the index has measured for this area in its six year history. Additionally, the transportation price index metric dropped 2.3 to 42.2. As noted above, a number under 50 means contraction, and this marks the fourth straight month the price metric has been in that range. Why? Because typical peak season demand and project-based volume simply hasn't materialized to blunt the slowdown of shipping activity that began earlier in the year. Maybe peak season doesn't exist anymore, at least this year.

By the Numbers

See the summary of the October 2022 Logistics Managers' Index, by the numbers:

.jpg?width=600&height=485&name=LMI%20October%20Graph%20(1).jpg)

About the Logistics Managers' Index (LMI)

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno - in conjunction with the Council of Supply Chain Management Professionals (CSCMP) - issue the report. The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in October 2022.

Need assistance with your shipping operation as the year winds down? Request a quote with us, and we'll get back to you to discuss your unique needs. Go to our Resources page to learn more about everything freight and logistics. Additionally, visit our blog for information and updates on the freight industry. Or start with these links below: