Definition of US Customs Harmonized Tariff Schedule (HTS)

The harmonized tariff schedule (HTS) is the primary source to classify goods imported and exported from the country, used by the United States Customs and Border Protection as a means to record international trade activity by product and collect duties and taxes. The foundation of the HTS is the baseline schedule used by all countries for international trade.

Each good imported or exported is defined by a certain code within HTS.

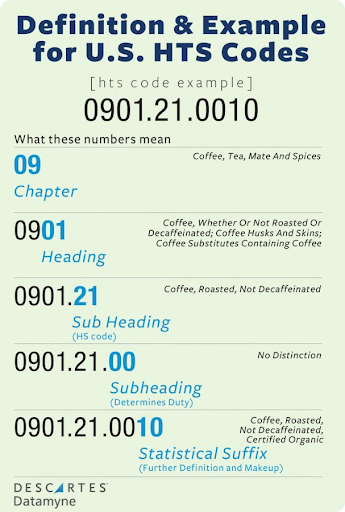

The HTS code is 4-10 digits. The first 6 digits are the same used by all countries in their tariff schedule. Digits 7 through 10 are unique by every country, so they can capture further details on products or make variations on the tariff.

In other words, these codes are not only important for assigning duties onto a traded product, but also providing data in terms of international trade.

An example explaining the tariff codes is provided to below by Descartes:

Based on the system created by the World Customs Organization(WCO), classification within the HTS must be in line with the General and Additional U.S. Rules of Interpretation.

The WCO’s 4- to 6-digit Harmonized Commodity Description and Coding System (HS) has been adapted into 8-digit rate lines and 10-digit categories.

Reasons to Use HTS System:

-

Consequences of Not Complying

- Firms will stumble upon several hurdles with international trade if they do not comply. The hurdles will increase if the shipper does not correct the situation with further inspection, fines, penalties, etc. The US Customs and Border Control does have the authority to freeze all imports and exports for shippers that are habitual offenders.

-

Reasons why compliance with the harmonized tariff schedule is of the utmost importance:

- Countries want to ensure thy are collecting the tariff, taxes and duties they are due.

- Countries want to ensure products are not illegally entering or exiting the country, as there are always products on a country's list that cannot be imported or exported from certain countries.

-

Competition Amongst Firms

- The HTS acts a standardization amongst all international companies. Through the HTS classification system competitors are on a level playing field because the same product, no matter what the company, will be held accountable for the same tariff and duties rate. This levels the playing field for competitors in the same line of business.

-

Perception of the Firms

- Another important consequence associated with not using HTS is public distrust of the company. Using the Harmonized Tariff Schedule is a benchmark for good practice on behalf of all international companies, which can affect the publics’ decision to purchase from the company.

The HTS is an important topic that is always under review for classification, tariffs and restrictions.

At times, countries us the rules and regulations associated with their HTS schedule to impose duties and tariffs against other countries, as a negotiating item to encourage a certain behavior or protect product being manufactured or assembled within its borders from cheaper options that can come from other countries.

The Harmonized Tariff Schedule acts as a crucial gateway to fair trade within international trade, warranting implementation within supply chain.

An important topic under the Harmonized Tariff Schedule is foreign trade zones. A foreign trade zone is a designated area that is authorized by US Customs and Border Protection (CBP), where commercial product receives the same treatment as if it were outside the US. The proper use of a foreign trade zone can defer duties or reduce them.

For more on how to improve your supply chain:

To learn more about InTek Freight & Logistics and the logistics industry, we invite you to visit our website and subscribe to our weekly blogs.