We talk to hundreds of companies a year about their logistics and supply chain teams.

We talk to hundreds of companies a year about their logistics and supply chain teams.

A top three goal every year is finding the high-quality service capacity at the best price, yet shippers moving full truckload freight 700 miles or more exclusively by truck are likely missing out on the capacity and cost-savings benefits of door-to-door intermodal transportation.

By converting or augmenting the truckload lanes that fit well with intermodal, companies can leverage intermodal for scalability, capacity, cost and sustainability.

Understanding Intermodal – When and Why

Intermodal freight transport involves the transportation of freight in an intermodal container or vehicle, using multiple modes of transportation (rail, ship, and truck), without any handling of the freight itself when changing modes.

Trains are used for the long-haul portion of a domestic intermodal shipment that leverages the efficiency of rail, while trucks are used to pick-up the freight at origin and deliver it to the origin intermodal ramp and then pick-up the freight from the destination ramp and deliver it to the ultimate customer.

The movement of goods via intermodal works well for freight lanes with 700 miles from origin to destination.

A well-managed intermodal lane will seamlessly integrate the origin dray (truck) with the line-haul movement (rail) with the destination dray and delivery (truck), and from a customer perspective – One Call Does It All.

Diversification of Logistics & Supply Chain Strategy

Diversification is the best strategy to get the most out of your 401K retirement fund, while intermodal is an excellent diversification strategy for shippers to diversify their 53’ capacity requirements to maximize logistics results.

Diversification is the best strategy to get the most out of your 401K retirement fund, while intermodal is an excellent diversification strategy for shippers to diversify their 53’ capacity requirements to maximize logistics results.

Below are some of the truckload risks that intermodal helps to counterbalance:

-

Driver shortages is a real issue and projected to continue to deteriorate.

-

Autonomous trucks are to help the issue, but that is not going to have a tremendous impact until at least another decade out from now.

-

Diesel prices have been holding steady, but there is enough political risk that could cause this to change quickly.

-

LTL solutions face the same headwinds as truckload carriers, thus cutting into 53’ capacity demands of shippers.

-

The freight industry has three characteristics that can cause unexpected spikes:

-

It is cyclical in nature, so at the trough of the cycle, motor freight carriers lighten their assets in a way that makes it difficult to turn them back in motion quickly.

-

Weather can wreak havoc on the “normal” flow of freight within networks causing the networks to be out of balanced at any given time thus causing capacity shortages and spiking rates.

-

There are strikes by some motor carriers or at ports of entry that cause delays and create an imbalance in the freight network.

-

The megalopolis population structure of the future will create more highway congestion that cannot be addressed through public funding alone, although it works well with intermodal ramp efficiencies.

-

Legal truck speeds, hours of service (HOS), size and weight does not appear to be increasing anytime soon, meaning there are no other outside factors that could help increase capacity with the same number of drivers.

How Shipper Demands Play Well into Intermodal

With the above truckload environmental characteristics at play within the 53' capacity, shippers demands on their supply chain performance will not change and probably will intensify because of e-commerce constantly pushing the envelope of:

-

Quicker

-

Scalable

-

Consistently Reliable

-

Transparent and Real-Time Track & Trace

-

Cost Competitive

The shippers that can be the most effective addressing the five demands will have an unmatched competitive advantage and intermodal is uniquely positioned to be the 53' capacity solution. Some may say otherwise because of the misconception of intermodal dancing in their heads, but intermodal has experienced significant growth since 2000. It's no coincidence Amazon and WalMart continue to push their way into the intermodal space.

Intermodal Growth Continuing into the Future

While carriers are slow to increase capacity and smaller carriers are finding it harder and harder to keep their doors open, railroads are still investing heavily to increase their market capacity and build out their networks for further coverage by:

-

Adding more equipment in locomotives and domestic containers.

-

Hiring additional crews throughout the intermodal network.

-

Investing in more technology.

-

Working additional process improvements

The end result of this investment is intermodal is continuing to step up capacity, while addressing the five other needs shippers have to build a competitive advantage in their supply chains.

Time to Jump into an Intermodal Strategy

It is time for all shippers to do more than dip their toe into intermodal. The significant role intermodal has to play within their supply chains is just too important to ignore.

Although there is still some reluctance of shippers to bring intermodal into their logistics and supply chain strategy, it could be argued that the unique position of intermodal actually places it in even greater growth patterns from the demand side of the supply chain equation, rather than the traditional supply or mode-carrier side, as has been seen historically.

So, if it has not happened already, it will not be long before you are asked to look into what intermodal can do to for your company. The good news for you is there is a ton of information on intermodal and it is no longer bleeding edge logistics.

Intermodal FAQ’s

As mentioned earlier, Intek speaks with hundreds of shippers a year about intermodal and have partnered with some of the largest players in the industry to not only be able to have one of the top intermodal services, but also be intertwined with the thought leaders in the intermodal industry.

Assembled is a short list of questions we are often asked in a shipper’s buying journey.

-

Will Intermodal Save Us Money?

Not in all cases, and it may not be available in the lanes your company runs. When intermodal is an option, the service saves shippers roughly 15-18% over their truckload options. Do not be surprised if you find the savings are across the board. In some cases, the lane may be more economical to run via a truckload option, but consider intermodal as a supplement to your routing guide for additional capacity. Also, we recommend reviewing some lanes every couple of months because market conditions can change in either the truckload or intermodal market.

To figure the potential savings on your lanes, engage at least one IMC. An IMC will help identify which lanes are a potential fit for intermodal and will be able to price each lane for comparison. We see where consultants have been brought in to do all this work, but this is not necessary when engaging an IMC that focuses on intermodal. Not sure which IMC you should work with? Call the railroads directly and they will align you with the best IMC for the work your company needs.

-

Is Intermodal Service Reliable?

Absolutely. Intermodal is a step better, it is consistent and reliable. The intermodal service is so strong that many shippers have converted their retail shipments to intermodal and saved on the chargebacks.

As with truckload, there will be service failures. These service failures tend to occur on either the origin or destination dray segment of the lane. Many IMC's like to lay blame for their service failures on the railroads, but the reality is the dray relationships the IMC has in their intermodal network is the key to success, so make sure to investigate how your IMC will handle its dray responsibilities.

Also, many shippers find intermodal tracking and tracing for intermodal is significantly more detailed than what they receive from their truckload providers.

-

What are the Transit Expectations?

Transits are typically truck, plus a day, but there are some lanes that have the same transit. The transit tends to be truck, plus two or three days when the containers are interlined between two or more railroads to make the full door-to-door move. See intermodal transit link for examples.

-

What are the Operational Questions our Company Should be Aware of with 53’ Domestic Intermodal?

There are a number of questions around this topic, such as: Pricing, Tendering, Tracking and Equipment. To dig into the answers, the blog entitled The Intermodal Shipment Process and Equipment Used quickly answers these questions.

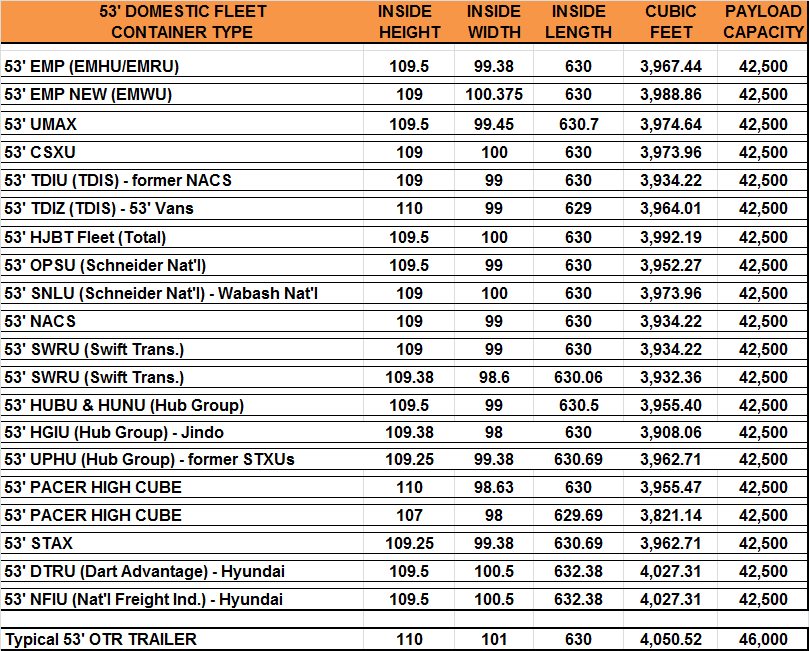

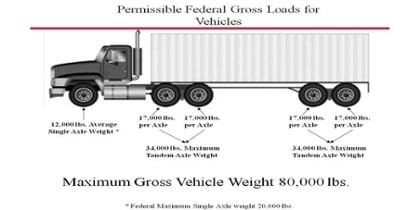

The key point under the operational questions is to understand intermodal is truckload-like, not just like truckload. Many shippers new to intermodal make the assumption that intermodal is exactly like truckload service, then are surprised by the weight difference that can be loaded: 42,500 versus 45,000 or they do not block and brace the load. Weight and blocking and bracing are the two most commonly missed operational difference.

One last item to keep in mind is intermodal is extremely efficient for the docks when a pool program can be instituted.

-

What Makes for a Great Intermodal Lane?

First off, not all lanes can be serviced by intermodal. The best intermodal lanes are roughly 700 miles with both their origin and destination drays within 100 miles of the ramp. There are some freight lanes that work at less miles, but these lanes are super dependent on the location of the ramps as it relates to the origin and destination of the lane serviced.

To learn more read the following blog: What Makes for a Great Intermodal Lane. This will help focus in on the best opportunities.

-

Does Domestic Intermodal Have a Peak Season and Is There a Way to Protect Our Capacity Requirements?

Yes, there is a peak domestic intermodal season. Peak correlates to the peak retail shipping season over the months of August through November. Shippers can protect against capacity by aligning with IMC's that offer year-round rates, with guaranteed capacity. Shippers need to be aware all guarantees are not created equal. Some offer a price guarantee, but they do not guarantee capacity. Other IMC's guarantee capacity, but not the rate and add a peak surcharge.

Rates and capacity can swing dramatically during peak, making good reason to protect against the surges of "peak", but not necessarily on all lanes.

-

Damage and What is This Blocking and Bracing all About?

Damage is not any more prevalent on intermodal than it is on a truckload shipment, as long as the shipper is aware of what they need to do to prevent damage. As with any 53' truckload, product must be secured in a way to ensure a safe and damage free move. However, unlike truckload shipments, intermodal loads experience harmonic vibrations that can move the load vertically, longitudinally and laterally. The vibration is not intense, but consistent and causes unsecured freight to move to open free space in the container.

To prevent movement in the intermodal container, blocking and bracing is required, but it is not as difficult as advertised. In many cases, blocking and bracing is often nothing more than securing a couple of 2 x 4's with 16d nails to the floor of the intermodal container or staggering the load in the container.

The last item on securing an intermodal load versus a truckload is unlike a truckload shipment, where shippers may push off the securement of the load to the driver, the intermodal shipper takes full responsibility for securing the load to protect their product and the safety of the load. With intermodal transportation, shippers expressly warrant their loads are properly blocked and braced in accordance with the American Association of Railroads (AAR) Terms and Conditions.

For more on the topic, read How to Ship Intermodal without Damage.

-

Who are the Intermodal Service Providers We Should Engage?

Intermodal service providers come in many varieties. The intermodal providers that focus on the industry are called IMC's (intermodal marketing companies). Railroads made a decision early on that they did not want to retail their intermodal service directly to shippers. This decision led to the advent of the IMC to perform the sales and marketing for the Class I railroads. Over time, IMC's evolved to provide not only sales, marketing and pricing, but also:

-

Secure container and/or dray capacity. (This is the only distinction between asset versus non-asset intermodal IMC's.)

-

Provide a layer of customer service support and reporting shippers obtain from other transportation modes.

-

Give shippers one call access to the West and East Coast railroads, since there is no one railroad that covers all the North American ramps.

Contrary to marketing material coming from asset intermodal service providers, asset versus non-asset intermodal transportation services providers cannot be delineated in the same way as asset and non-asset truckload providers can be viewed in the OTR market. The asset intermodal service providers work hard at planting the "broker" seed that cause some shippers to shy away from working with non-asset truckload providers. The long and short of it is, there is no one intermodal company that owns all the assets in an intermodal move, so to compare to a non-asset truckload provider is not an accurate way to portray the non-asset intermodal service provider. The question shippers need to ask themselves is not asset or non-asset, but what provider will deliver the best service for their company. Both asset and non-asset have their niche where they have an edge over the other.

-

Is Intermodal an Option for Canada and Mexico Cross Border Shipments?

Intermodal can be used for Canadian and Mexico shipments. There is not a significant difference in the process of shipping in either country, as compared to truckloads in or out of these markets.

The following information is all that is needed to start the process. With the information below, the InTek team will do the analysis and build a customer program. If you want to provide the current costs. InTek will assemble the full analysis for your management team.

-

Provide details on your current lanes regardless of mode.

-

Origin and destination zip codes.

-

Frequency of moves.

-

Commodity.

-

Weight.

-

Haz-mat. If so, what is the commodity?

-

Temp controlled. If yes, then what temperature?

-

Will the loads be live loaded and unloaded?

-

Any special instructions or handling requirements of the product or the docks the product will touch.

-

What is the rail schedule and does the train depart every day of the week?

The key intermodal corridors run every day, but the lesser traveled lanes do not, so make sure you get a real good understanding of the transits by day of the week. Don't forget freight traveling over the weekend is a winning proposition on intermodal transit.

When it comes to transits, there is also a price component. In other words, some lanes (not all) have various transit times. The slower transit will have a lower price. Typically, this will come up in the quote process, but it does not hurt to ask yourself to make sure all the bases are covered.

-

What type of visibility will I have on the shipment in transit?

When it comes to service and visibility, do not take the pressure off the intermodal provider. Some providers tell their shippers they cannot provide a great deal of visibility "after all it is the railroads you are working with". This comment could not be further from the truth and is frustrating to hear. The visibility provided by the railroads is similar to the multiple scans a small parcel shipment receives in the FedEx and UPS network. Do not accept anything less.

-

Are there any restricted commodities?

The answer is that there are restricted commodities, so make sure you share the details of your commodity with the intermodal provider. Also know that while some commodities are restricted, they can also not be restricted and that is based on how they are packaged.

What are the container dimensions?

- ISO Containers 20' / 40' / 45' - Some lanes and commodities lend themselves to the re-positioning market (repo market). The 53' containers stay domestically, meaning within North America, while the ISO containers are used for import and export business. The issue for the steamship companies is to get the containers back to the ports with as little empty miles, which on the "right" lanes work for domestic freight moves, particularly for freight that may weigh out before it cubes out.

- 53' Reefer Container - The temperature controlled market continues to expand and intermodal is trying to grab its share. The number of containers is still limited, so not available on every lane and there are also commodity restrictions, but still an option to at least consider.

-

What is the maximum weight that can be loaded?

The standard weight associated with a domestic intermodal load is 42,500. There are exceptions, but more times than not, 42,500 is the maximum amount that can be loaded in a 53' domestic intermodal container. Many new intermodal shippers do not ask this very important question and find themselves frustrated, as the shipment comes back to their facility to re-load with additional costs.

For more on this topic, please read "Intermodal Weight - The Most Common Issue for New Intermodal Shippers".

-

What is an IMC?

An IMC is the acronym for intermodal marketing company. IMC's purchase rail and truck transportation services, utilize equipment from multiple sources, and provide other value-added services under a single freight bill to the ultimate shipper.

Consider an IMC as a broker or logistics service provider (LSP) for door-to-door intermodal transportation services. Class I railroads do not sell intermodal service direct to shippers. Instead the railroads sell wholesale to IMC’s that then sell to the BCO (beneficial cargo holder) or shipper.

-

What is the Difference between an Asset and Non-Asset IMC?

The difference between asset and non-asset IMC’s is an asset IMC owns the 53’ intermodal containers it uses for their intermodal freight moves, while the other does not. Some asset IMC’s also own and operate their dray equipment. The largest asset IMC is JB Hunt.

InTek Freight and Logistics would be considered a non-asset IMC, since it uses the 53’ intermodal containers owned by the railroads and buys its rail capacity direct with the Class I railroads.

Some asset IMC’s own very few containers and move the rest of their intermodal freight capacity as a non-asset IMC, so if aligning with an asset intermodal provider is important to you review the chart below on the companies owning intermodal assets.

-

What is the Number One Issue Our Company Should be Aware of with Intermodal?

The biggest issue with intermodal shippers is associated with weight. An intermodal container handles 42,500 pounds versus 45,000 for a truck and because freight moves on an intermodal container on the rails than over-the-road can cause the load to shift making it illegal on weight distribution allowed per axle.

The issue is easily address, but shippers need to know that loading patterns can vary for intermodal versus truckload.

-

Our Company is New to Intermodal, so Who are the Biggest and Best with Delivering on Intermodal Service?

Unlike the highly fragmented truckload market, the majority of intermodal shipments are handled by less than 10 companies. To learn who the best and largest are we forward the blog entitled Best Intermodal Companies (And How to Choose) to our prospects to read in detail on the topic.

-

Explain the Environmentally Friendly Aspects of Intermodal

An intermodal train can carry the equivalent of 280 trucks and with dray on the front or the back of the lane is typically 50 miles or less, which allows dray carriers to turn a tremendous number of boxes in a short period time.

- Intermodal is 4 times more efficient than trucking freight.

- Rail can move one ton of freight 450 miles on a single gallon of fuel.

- Reduces carbon footprint.

- A train emits approximately 5.4 pounds of carbon dioxide per 100 ton-miles whereas trucks emit approximately 19.8 pounds.

- Trucks moving 40,000 lbs. each going 3,000 miles produces an estimated 17.4 tons of carbon emissions, while the equivalent of these trucks placed in intermodal service produces an estimated 7.0 tons of carbon emissions.

-

Are the rates given spot, special project or an extended rate quote?

All three types of rates are available. In addition, shippers can have a full year rates with a capacity guarantee to protect against peak season. The full year rates require a minimum number of shipments per lane of 2 to 5 a week, depending on the lane.

-

Can You Help Me with Intermodal Terminology

Chassis - Base frame of a motor vehicle or other wheeled conveyance.

COFC – (Container on flat car) the movement of a container on a railroad flatcar, the movement of which is made without the container being mounted on a chassis. This not only allows for a container on flat car, but also gives us true Double Stack – container on container on a flat car. This offers the best economics from an intermodal perspective.

TOFC – (Trailer on flat car) a rail trailer mounted on a fixed chassis that is transported on a rail car. This is generally used by LTL carriers, Over the Road Carriers (yes, believe it or not) and by companies that handle small packages for delivery to metropolitan areas. While the economics certainly are an improvement over pure truck, they are not as dynamic as the economics associated with COFC.

Ramp to Ramp – A movement of lading from the intermodal ramp (rail) closest to the shipper to the intermodal ramp (rail) closest to the receiver.

Door to Door – A movement of lading from the customer’s door (dock) all the way through delivery to the receiver’s door (dock). This is generally known as a TRT move, Truck/Rail/Truck and is the service most in demand from a shippers perspective.

Blocking and Bracing – Methods utilized to keep the shipments in place and to prevent shifting of the cargo during the movement of the truck and rail. Also known as “dunnage”, and please keep in mind, over the road trucks also rely on blocking and bracing in an effort to prevent shifting cargo, this is not a term that is specific to Intermodal.Interline – Is freight moving from point of origin to destination over two or more transportation lines.

For more terms and definitions visit our web page entitled Intermodal Transportation Terms & Definitions.

If you find your analysis to be favorable for intermodal, our team would love to be a part of the conversation.

InTek Freight & Logistics is closely aligned with all the Class I railroads to the point we are co-marketed with the largest. This relationship allows us to bring together the resources necessary for a successful implementation of an intermodal strategy to a company’s supply chain. As part of the process, InTek brings in the Class I Railroad Damage and Loss Control resource to build the load diagrams for safe and damage free loads.

As we close this article out, we invite you to learn more about InTek Freight & Logistics through our website or follow us on our weekly blogs for weekly publications on how to improve your logistics and supply chain.

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (54)

- Freight Broker (60)

- Freight Forwarder (2)

- Intermodal Transportation (185)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (421)

- Logistics Service Provider (77)

- LTL (39)

- Managed TMS (49)

- News (39)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (122)

- Warehousing & Distribution (50)