Financial advisors and logistics professionals are similar in that they both recommend diversification. For financial advisors that comes by way of a diversified portfolio of stocks, while a logistics professional needs diversification in their selection of freight modes to strengthen their ability to obtain freight capacity at the best price.

Financial advisors and logistics professionals are similar in that they both recommend diversification. For financial advisors that comes by way of a diversified portfolio of stocks, while a logistics professional needs diversification in their selection of freight modes to strengthen their ability to obtain freight capacity at the best price.

Long time readers of our blogs have been hearing about the importance of a diversified carrier base for years as the best way to optimize their company’s logistics and supply chain execution strategies for price, service and capacity.

Some of our most popular articles to help with the topic of diversify a company’s 53’ freight capacity requirements over truckload and intermodal include:

- Why Diversification of Truckload & Intermodal is Key to Logistics Success

- Comparing Truckload vs Intermodal: 11 Differences Shippers Should Know

- Intermodal Transportation - Beginners Guide and FAQ's

Introducing or utilizing more intermodal freight options is one method to diversify 53’ capacity requirements.

Up until 2018, when the freight market experienced one of its most capacity challenged years, there was a 12% to 18% price advantage intermodal had over truckload, but that advantage has narrowed making capacity the new value proposition for intermodal. The Journal of Commerce analysis of intermodal versus truckload pricing report speaks to the change.

Now the best time to put diversity into a logistics strategy is quote your 53’ intermodal annual contract capacity over the months of February and March, but that is not always an option for shippers that find themselves behind the 8-ball in gaining capacity in years like 2018 and 2020.

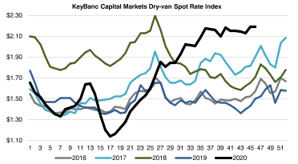

So, for those not already operating a diversified 53’ capacity strategy you’ll find yourself in the spot rate market, which is not where one wants to be in capacity challenged times where pricing pushes to all-time highs, as the below charts illustrate.

Options for Shippers Struggling with Freight Capacity

With all the background behind us let’s jump into the other options shippers have available to themselves if they are struggling for freight capacity and an their freight lanes fall into those areas that are driving the crazy high spot rates.

The two options include working with a freight provider that offers 40’ and 45’ ISO intermodal containers for inland domestic shipments or one that works with truckload trailer manufacturing companies.

Both the ISO container and trailer options provide capacity and both utilize the Class I Railroads to move the equipment for the long haul segments of the shipment process, but that is where the similarities end.

40’ and 45’ ISO Containers for Shippers Struggling with Freight Capacity

Even though this is not the cube you get with a 53’ trailer or domestic intermodal container, you’ll want to read all the way through the ISO container option.

Many shippers utilize the ISO container freight capacity as a part of their standard freight strategy. The companies that typically find value in the 40’ and 45’ intermodal service on a consistent basis are those that have a product that weighs out before it cubes out. Not only does it reduce the space in which the product, so less blocking and bracing to consider and the shorter equipment allows them to load heavier than standard 53’ equipment.

The reason the 40’ and 45’ ISO import containers exist is they are a by-product of steamship companies sending importer shippers’ freight inland. These containers are essentially then orphans in the market trying to get back to a point in the steamship’s company container supply that can either be used for an export or sent back empty.

The trade imbalance between the US and Asian-Pacific causes roughly 60% of the containers to go back empty, so whatever the steamship company can do to have fewer miles empty helps their bottom line. What that means to shippers is capacity others do not consider and a much better deal on price.

The movement of these containers is called the intermodal repositioning market or intermodal repo market for short.

In times where supply of freight capacity is low and pricing is crazy high, as was illustrated in the earlier, the 40’ and 45’ containers are still a much lower priced capacity option for shippers that can be flexible in how they move their freight.

There are some repo markets where a shipper can actually get more cube at a significantly lower price than in the standard 53’ market. As an example, a shipper can procure two ISO containers for the price of one 53’ trailer or container.

Truckload 53’ Trailer as an Option for Freight Capacity

The truckload trailer is an option but tends to be fairly limited because the origin-destination zip code pairing is specific to where the trailers are manufactured (origin) and where the ultimate buyer of the trailer is located (destination). The trailer option is also limiting in the fact that trailer truck orders tend to go in waves, so the availability and need are very specific and difficult to make work for shipments that are time sensitive.

Additional Data on Using ISO Repo Intermodal Service

The domestic service model of relocating empty surplus ocean carrier equipment is not only getting them to ports, but also includes getting them to deficit areas where another shipper will be using them for an export.

The importance of these two movements is the ocean containers have many options for freight providers that offer repo service to the shipping community.

The repo service is a door-to-door service that takes one phone call and ends with one invoice. The shipper does not have to worry about coordinating the various segments of the shipment and managing the costs associated with each. The freight provider will quote the entire shipment, do all the work in coordinating the shipment from pick-up to delivery, then close with a single invoice.

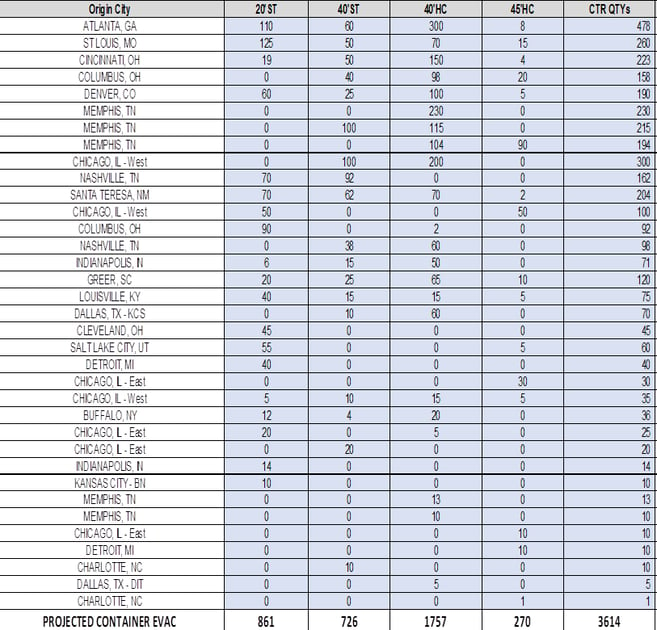

The market options vary by week, so capacity is not as fluid as the standard 53’ market, but it is not as sketchy as the trailer option mentioned earlier in this article. The logistics provider receives a daily sheet on the container availability by market segment, meaning Northeast, Southwest, etc. that they can offer shippers.

An example of one such market snapshot sheet is illustrated below.

Top 5 Examples Within a Shipper's Business Where 40' & 45' Containers Make the Most Sense

In times of severe freight capacity shortages, 40' and 45' intermodal containers help all shippers.

While the above holds true, there are four additional situations where shippers can benefit all year round, which are listed below:

Shipments that weigh out before they cube out are excellent candidates for the smaller boxes.

- A short list of commodities that come to mind include: canned food and beverages, pet food, lumber and lumber products, paint, paper products, resins/chemicals and specialty steel.

- An added advantage for those shipments that weigh out before they cube out is the smaller box may be just the right size to further help the blocking and bracing needs domestic intermodal brings to its 53' lanes to prevent shifting of the load.

Heavier shipments that require more than the 42,500 weight limit associated with 53' domestic intermodal containers.

- 53' domestic intermodal can be loaded to 42,500 pounds, but for shippers requiring more weight capacity the ISO container is an option. The shorter intermodal container weighs less, as does the chassis allowing for more weight to be loaded onto the intermodal box.

Shipments moving from the interior points of the US to US or Canadian port cities.

- The small ISO boxes are intended for international import / export shipments, but with the US economy importing more than it exports creates an imbalance of containers that shippers can use to their advantage. The imbalance creates motivated steamship line pricing for their boxes on these lanes because some revenue is better than no revenue.

Shipments that are less time sensitive.

- The domestic 53' intermodal shipments have transits of truck, plus a day. While there are situations where the small boxes have similar transits, this is not the case for all ISO box lanes and the situation can be more fluid. So, while 53' domestic works well with appointed retail deliveries, ISO containers may be a different story so check with your intermodal freight service provider.

Conclusion on Using Ocean Containers in Your Shipping Strategy

The repo market is a win-win-win. The service provides: shippers needing freight capacity at competitive rates; ocean carriers moving more freight and less empty miles; and companies like InTek being able to offer shippers a one-stop freight capacity provider to the market.

So, if you are still interested in learning more we recommend the following articles:

- The Complete Guide to Intermodal Transportation

- Cost of Intermodal Transportation Services (Rates, Fees & Variables)

- Freight Costs: An Insider’s Look on Freight Pricing Buyers Should Know

- Pros & Cons of Using Intermodal for Your Company's Shipments

- Asset vs Non-Asset Intermodal Freight Providers: A Detailed Comparison

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (54)

- Freight Broker (60)

- Freight Forwarder (2)

- Intermodal Transportation (184)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (420)

- Logistics Service Provider (77)

- LTL (39)

- Managed TMS (49)

- News (39)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (122)

- Warehousing & Distribution (50)