It is hard to believe 2023 is half over, with the July 4th festivities already in the rearview mirror. We've all learned a lot in these past six months, as it relates to the freight market trends and what to expect in the logistics and supply chain market for the remainder of 2023 and into the start of 2024. Over the next several paragraphs we'll take a snapshot of the current freight market, look back at what we predicted correctly and incorrectly in January, then walk through our expectations for the remainder of the year and beginning of next year.

Summary on Current Freight Market Trends

From a freight provider's perspective the transportation market has been treacherous, while shippers have found they are in the driver's seat.

And while that might sound great for shippers, it really isn't because there are two reasons freight rates decrease: demand is down and/or supply of freight capacity is up. We happen to have both conditions in play currently. We'll get a better sense of the demand side in the coming month of freight market trends, as publicly traded shippers will report their 2nd quarter earnings.

But what we've heard from many is their revenue is slowing down, and they are still working to get their inventories in line with the reduction in sales. For retailers, this has meant discounts to their customers. Nike, Target and Estee Lauder reports are a few earnings calls worth listening to for a more micro look at the shipper situation.

As for the supply side, meaning freight carrier capacity, there are many metrics to look at for a sense of the current situation. There are FTR, ACT, Cleveland Research, the Logistics Managers Index (LMI), and a number of other indexes. All these resources are showing the same thing: excess capacity that is dropping, but not quickly enough to stabilize the decline in spot and contract freight rates.

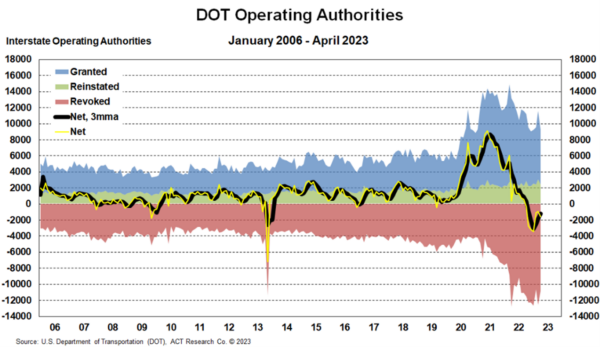

A metric that illustrates a drop in the total supply of freight capacity comes from the net increase / decrease of operating authorities issued by the FMCSA each month. Here too is a domestic U.S. statistic that illustrates asset carriers are leaving the market. We've also heard from the Journal of Commerce reporting that the largest carriers have pulled 5% of their assets off the road. With demand being down and no relief in operating costs for truckers, we'd expect the number of net gains to be negative and additional bankruptcy announcements from larger carriers to run through the end of the year.

While the supply side of the freight market is working its way off a bubble created by the record high spot freight market, the demand side has no significant catalyst on the foreseeable horizon to increase demand for goods. In fact, the Federal Reserve continues to use interest rate increases to drive down inflation. The expectation is consumers will continue to curtail their purchases to protect themselves from an expected recession.

The end result is for freight rates to push back up and volumes to increase. In this particular freight recession, there will be a shift in both the supply and demand curves that will eventually drive the freight market to equilibrium - a base from which to eventually grow again.

The process of the shift in demand and supply appears to be extending into next year. Freight rates are in their bottoming process, but holding at their lower levels until an upward demand catalyst hits the market. That catalyst will probably be correlated to the Federal Reserve cutting rates - something not expected to happen until the second half of 2024.

With the summary on the freight market behind us, let's jump into more of the details starting with our initial look at 2023 and then peel back the onion on the freight market future.

Look Back on InTek's Original 2023 Predictions

To start, let's look at what we got right and where we missed the mark on our January 5th article entitled Logistics and Supply Chain Trends: 2023. We do this because we need to call our errors, so we can get to better answers moving forward.

Correct Predictions

- Depressed Volumes: This was an easy call for just about every logistics professional. After having two record-breaking years, it was inevitable for volumes to push lower. The decrease began in the second half of 2022 and history has shown us downturns last a minimum of one year. Not every analyst thought it was going to be as bad as it turned out, but we certainly hit the mark on this prediction, which led us to our next insight.

- Rate Wars: We couldn't have picked a better phrase in the expectation of rate declines. Since the beginning of the year, freight providers have been repeatedly hit with RFQs and mini freight bids. Some shippers have done as many as four re-bids in the first six months of the year. Some of the re-bids have been internally driven, while others have been prompted by freight carriers taking in new rates to shippers that then forced shippers to re-bid the new proposed freight rates to their carrier base to work even better freight rates for their company. This has been a very successful tactic by shippers, as incumbent carriers and freight brokers know all too well that it is easier to keep a customer than get a new one.

- Widening Equipment Availability: Trucking and intermodal companies have equipment idled at various depots across the US because volumes have been depressed. Even with the parked equipment, there is still extra equipment sloshing around in the freight market. Perhaps counterintuitively, we are seeing spotty areas where a narrow group of asset providers are out of equipment even as they have trailers and boxes parked in other locations. These spotty shortages are driven by the depressed freight volumes that have created an imbalance in the carriers' networks.

- Logistics & Supply Chain Technology on the Rise: After a hectic 2021 and 2022, shippers and freight providers have extra cash to invest in their business. Those confident in their business models succeeding through the current freight recession are using the cash to upgrade their technology to better position their customer offering on the next supply chain disruption.

- Cybersecurity: As a subset of technology, the rise of supply chain disruptions caused by various cyberattacks from either bad actors having time on their hands or for politically motivated reasons has put cybersecurity on the planning map, as we fully expected.

Missed the Mark

- Return of Intermodal: We missed the mark on the return of intermodal volumes coming back to a more normalized state, but we should have known better. The reason we say we should have known better is historically intermodal volume does not return in a meaningful way until the trucking market begins a recovery of its own.

- Second Half Freight Volume Recovery: We thought there was going to be a freight volume recovery in the second half of the year for a number of reasons. The top two catalysts for the second half recovery were companies would be successful in "right-sizing" their inventory positions in the first half of the year and interest rate reductions would be on the table by the second half of 2023 because the historic rise of interest rates by the Federal Reserve would curb inflation quickly. Neither of these have hit the expected timing. Inflation has proven to be stickier than expected and some industries are finding it harder to cut their inventory levels with consumers spending more in the service sectors than consumer goods. More specifically to the interest rates, the service industry is the hotter piece of the consumer economy at this time and is not as easily and immediately impacted by interest rate hikes.

Freight Market Volume and Rate for the Remainder of 2023

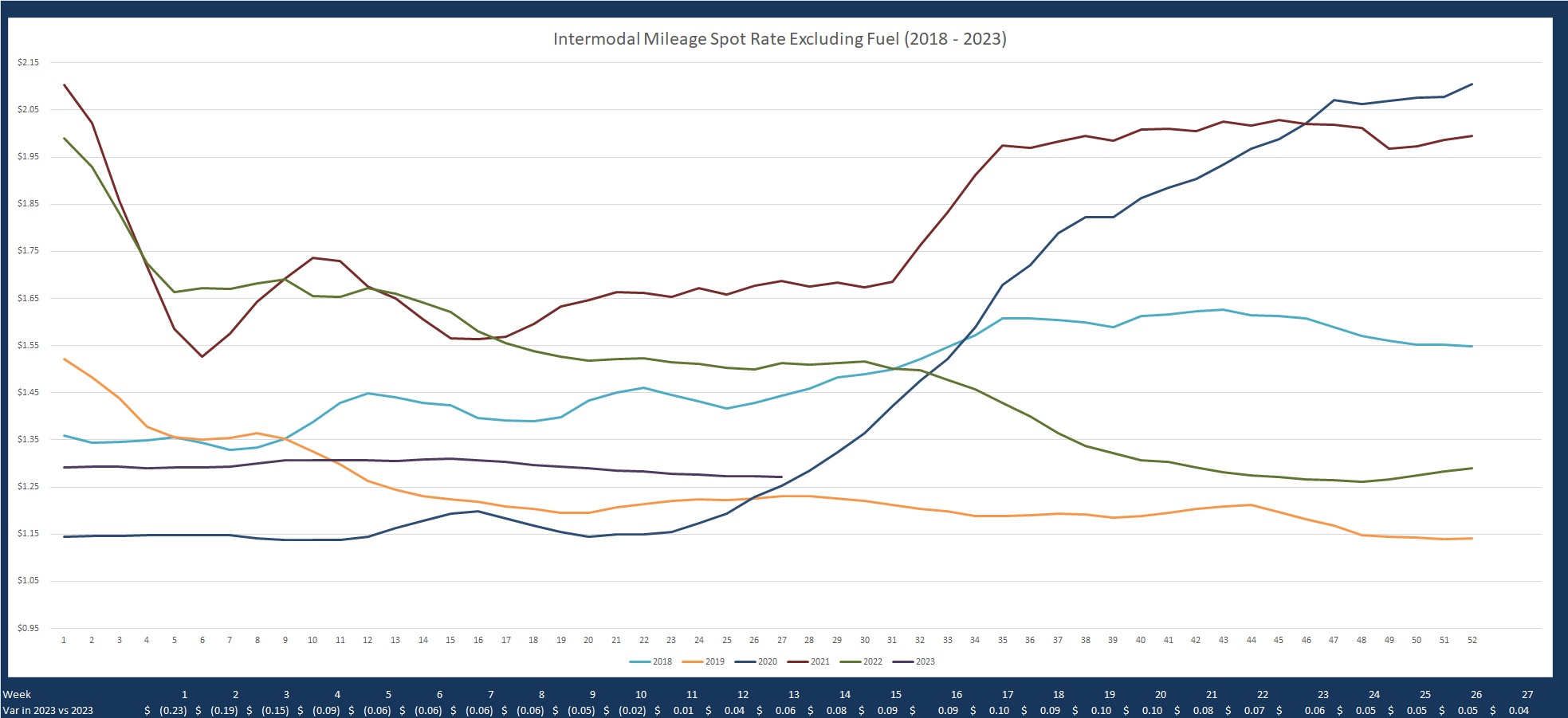

After the first six months, we feel the key to know what to expect in the next six months is to look at 2019. Rates are trending almost identically in the TL and IMDL spot freight market. Monthly volumes are also trending in the same fashion. So, without a catalyst, one should expect 2023 to remain relatively flat with little to no peak freight shipping season. And the same holds for the 1st half of 2024, because without the pandemic, the US economy was set for a recession in the first half of 2020.

Looking further at the macro level of the freight and logistics market leads to the Logistics Managers Index (LMI), which as mentioned is at its lowest point over its 6.5-year history. June's LMI went further into contraction mode, with it being the second consecutive month of a reading below 50.

Breaking the details down further, the key to getting rates and volumes back involves both the freight capacity supply to decrease and a demand catalyst to hit the market. So, let's dig into the truckload, intermodal, LTL and import volumes in more detail, with the majority of focus on the TL and IMDL market.

Through all the change that has occurred to this point in the freight market and moving forward, understand that freight is cyclical in nature and always has its ups and downs. So it pays not to panic or make drastic forever changes but instead adjust on what is being served up at the time. As it stands currently, the U.S. truckload market is nearing the end of the classic market cycle: the oversupply of freight capacity phase. Next will be the early days of transitioning to the first phase of the next cycle: the balance/recovery phase. During this time, the market recovers and balance between supply and demand comes back into play.

Truckload

Let's start with the supply side, meaning truckload freight capacity. The number of trucking layoffs and FMCSA operating authority revocations will continue at elevated rates that will carry through to the end of 2023. According to ACT Research, roughly 100k job reductions will occur over the course of 2023 between public and private fleets. The below DOT operating authority suggests 25,000 net fleet exits by the close of the year.

This contraction in trucking and employment is a part of every freight cycle and this consolidation is a normal part of the process of bottoming to then set-up for a solid recovery when freight volumes return.

One piece that is off-trend is the largest truckload carriers, as tracked by the JOC, pulling roughly 5% of their fleet capacity. In previous cycles, we've seen the cut occur after the operating authorities decline significantly out of the market. This move indicates two things: the larger carriers see the writing on the wall and are exercising more discipline than prior cycles and the 97% of trucking capacity that comes from fleets with 20 and fewer trucks holding out longer because of the record run from mid-2021 to mid-2022.

While the supply side appears to be in its typical bottoming phase process, demand is far more elusive and harder to predict a recovery.

There are a few areas analysts are looking for a catalyst: housing market, Federal Reserve rate cuts, reshoring and right sized inventories across major shippers. On the housing front, the US is under housed and trying to catch up quickly. Reshoring drives additional investment in facilities and equipment, along with more localized North American traffic. Right sizing inventories will drive restocking, which is hit and miss between industries and companies within industries. Finally, the Federal Reserve cutting rates does not appear to be on the table until 2024 because of stickier than expected inflation and strong employment.

Intermodal

Unlike the highly fragmented truckload market, the intermodal market consists of a handful of IMCs that drive the market making the process of bottoming and recovery much different. For intermodal, contraction is done by parking intermodal containers by the top 10 providers. Those asset or hybrid IMC's that occupy number 11 through 20 of intermodal providers may exit the asset business, to get back to being strictly a non-asset intermodal provider, by selling their assets, meaning their intermodal containers.

So, essentially the intermodal providers the bottoming process is to engage in strategic pricing competition to hold current business and gut out the downturn, while pressing other aspects of their business model until the market turns positive.

From our perspective intermodal pricing is at the bottoming stage, like truckload. Both the intermodal and truckload spot freight rate look very much like 2019 where the spread between the 2-years is less than $0.05 a mile, yet carrier operating expenses are up so this gets back to why there will be an acceleration in the decline of DOT operating authorities until volumes and rates recover.

Summary of 2nd Half 2023 Look at Freight Rates

Truckload and Intermodal Rates Bottoming

- Some have said the bottom hit in April and others are saying this month or next.

- Expect the TL contract to lag 2 to 3 months in hitting its bottom.

- Without a demand catalyst spot and contract rates will remain at the bottom into the 1st half of 2024.

Truckload and Intermodal Market Trends to 2019

- If you are looking for a comparable year in freight rates and market for TL and IMDL, we’d recommend comparing it to 2019. (We’re not the only ones making the comparison to 2019. DAT’s lead analyst spoke with us on our podcast saying the same thing.)

Where and What Will be the Catalyst for Freight Demand to Increase

- Housing Market Rebound

- Reshoring

- Federal Reserve Rate Cuts

- Restocking Resumes as Retailer Inventory Levels "Right Sized"

Next Steps

To succeed with the current trends, one needs to be plugged in the market and be willing to adapt quickly to any new market information.

To navigate these shifts successfully, shippers must remain flexible and agile, adapting their strategies based on evolving market conditions. Diversifying transportation modes and carriers will help.

At the risk of being repetitive, keep in mind that this freight cycle that we are in is a very normal process, so stay alert and don't be drawn into the extreme adjectives you'll hear or read.

With that said, be alert to the imbalances that will drive short term rate increases that would make it look like the market is turning only to find out that it is an imbalance issue driving a change. These imbalances will swing back and forth until settling into a more normal pattern that will allow you to make a tactical change for the better.

Keep a close eye on fuel, as there are not sustainable increases in the freight market without fuel going up. This is because fuel is a factor of economic growth, so without fuel increasing there is not a sustainable rally in freight.

We've talked a lot about economic indicators and trends but watch for regulatory changes also. With the major supply chain disruptions over the last couple of years, regulators are looking for ways to better understand and control the next disruption and as they squeeze on part of the balloon it often impacts another side of the equation that was missed.

To close, the freight market trends are complex, so no need to do it all on your own. Connect in with people you know and trust to bring you unbiased information, along with solid suggestions on what moves to take next or be that sounding board to bounce ideas that you have for your company.

If you're looking for help deciding on the freight shipping options for you, let us know by filling out our brief Request a Quote form. We'll be happy to get back to you to discuss your unique needs. If you need more information about this or other freight topics, browse our Freight Guides for free eBooks and comprehensive articles, or check out more of our blog.

Get Updates

Categories

- Freight & Shipping Costs (53)

- Freight Broker (58)

- Freight Forwarder (2)

- Intermodal Transportation (182)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (415)

- Logistics Service Provider (76)

- LTL (39)

- Managed TMS (49)

- News (38)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (121)

- Warehousing & Distribution (49)