After thinking we had said just about all there was about intermodal and rail shipping, we realized we were wrong after reading two recent postings: Union Pacific’s article Three Ways to Connect with Rail - And How to Make Them Happen and Intermodal Association of North America’s infographic, What is Intermodal?

So, after the gentle reminder that there is still more out there to be said on intermodal, we’ll jump right in with sharing options on how to utilize rail and intermodal in your logistics and supply chains. Afterall, who doesn’t like to save money and the environment, which is exactly what intermodal and rail shipping can do for a shipper, so clearly there will never be enough said.

With all that in mind, let’s delve into the topic of intermodal and rail for shippers.

In our conversations with shippers, we still find confusion between intermodal and rail, which often leaves them on the outside looking in as to how to engage an intermodal transportation solution they can implement into their supply chain service equation.

Typically, the easiest approach to bring intermodal to a company is to find those truckload freight lanes that are best for intermodal and then execute a modal conversion strategy in that lane. However, there are times this does not work for a shipper, but don’t despair, there are plenty more opportunities to bring intermodal into your logistics and supply chain strategies if that is not an option for your company.

Rail can be a little more difficult to implement, but there are still solutions that allow shippers to bring this mode into their logistics and supply chain strategy.

Where to Utilize Intermodal in Your Logistics Strategy

Intermodal

One of the quickest and easiest ways to bring rail efficiency and capacity is to implement a freight and logistics strategy to bring intermodal in as a complimentary or additive capacity alternative to truckload lanes.

There are some key freight and freight lane characteristics that make for a great intermodal lane, which include:

- The freight lane origin / destination pair or O/D pair is 700 miles or more, with the origin and destination ramps being no more than 100 miles away from the intermodal ramps that serve them.

- Weight is less than or equal to 42,500 pounds.

- Freight transit can include an additional day of transit, as most intermodal lanes are what we call truck, plus a day. If the load needs to be interlined to another class I railroad in its journey, expect transit to be truck plus 2 days.

- The freight does not have to be high-value, but high-value freight is far more secure on the rail than over-the-road.

- Capacity requirements make it difficult to fill all orders with current truckload capacity. Fence orders, from big box retailers, promotions, seasonal freight demands, or just high volume lanes often need additional capacity, and intermodal is a tremendous option to throw a lot of equipment and drivers at one time.

- When visibility is of the utmost importance, intermodal is your best option. As the intermodal container travels across North America, the container is scanned at various points, much like a small parcel shipment from FedEx or UPS.

Transloading

For shippers that find they do not have freight lanes that work well with intermodal or rail shipping, there is always the option of choosing a transload option.

Transload is is the process of transferring a shipment from one mode of freight transportation to another. It is most commonly employed when one mode cannot be used for the entire trip.

Transloading often occurs with imports or exports. On the import side, shippers will transload their product to either better control their product into the various regions of the US or to save on the total number of international intermodal shipments by transloading to 53’ intermodal containers. The latter solution allows for shippers to essentially move every 4th shipment for free because the additional cube a shipper gains in a 53’ container versus a 40’ container is significantly improved.

Transloading also comes into a logistics strategy when a shipper sends their product into a rail-sided warehouse via a train. Once the product is unloaded from the railcar, the product ships from that facility via intermodal, truckload or LTL freight modes. This is often a great solution for companies that ship heavy, bulky product. A couple of industries that choose this option include building products or paper.

Forward Positioning Inventory

Forward positioning inventory is a strategy where a shipper sets up a distribution point for their product in a region that allows them to service their customer within one to two days of their order. This strategy is often found when supporting just-in-time (JIT) manufacturing facilities, but can also be a tremendous ecommerce strategy.

Where rail comes into play with this strategy is the shipper can utilize intermodal for the linehaul stocking lanes into the forward positioned warehouse location. This strategy gives shippers the advantage of shipping in bulk to the regional DC’s for the economies of scale, then finish off the final-mile delivery in the most economical fashion to take advantage of the forward location.

Often the strategy used here is multi-stop LTL “milk-runs” or other consolidated methods for parcel and LTL shipments.

Work with Class I Railroad to Put in Rail Connection

While putting in a rail sided building has limited options because the importance of location on cost is so significant (along with the lead times of the product moving via rail cars being significantly slower than truck and intermodal) the potential can increase for shippers willing to engage a third party logistics company (3PL) for a facility that is already on rail tracks.

The potential to engage increases further if the shipper can segment out a piece of their business that would benefit from moving via rail from that piece of business that would not versus making it an all or nothing proposition.

An alternative to the 3PL option exists for shippers re-evaluating their freight network and adding facilities because they can include proximity to a main rail line within its DC RFP. In addition to adding the requirement to the RFP, they can also include state and local authorities to the process to lobby for tax incentives to help offset the cost of the rail line being added.

We will throw up cautionary flag to shippers thinking about adding a rail sided DC. While a facility may have tracks already to the building, they may not be deemed safe by the railroads that would be moving equipment on them, so engage the main line operator to have them evaluate the condition of the tracks. The cost of revitalizing the tracks could be more than putting a whole new line in for an operation.

Pooling & Consolidation

Similar to the forward positioning strategy, an LTL consolidation or freight pooling operation can take advantage of 53’ domestic intermodal, instead of truckload, for the linehaul segment of the strategy.

Under the pooling and consolidation strategy, intermodal transportation can be brought into a company by utilizing intermodal service for the linehaul segment of the strategy.

Choosing the Best Rail and Intermodal Strategy

Once a shipper decides it is going to bring in one of the above rail and intermodal freight strategies, they need to decide which mode will work best for them because rail, international, and domestic intermodal all have different attributes.

So, with that in mind, let’s walk through the various options.

For importers / exporters, there are two intermodal transportation service options: IPI & domestic intermodal.

International Inland Point Intermodal (IPI)

International-Inland-Point Intermodal, better known as IPI, is the intermodal service option where shippers move the container intact in 20’, 40’, and 45’ ocean containers. This option is typically the easiest, but not always the cheapest or best inventory positioning strategy.

IPI Move Consists of the Following:

- With IPI import intermodal service, the container arrives at the port.

- The container is loaded directly on a wellcar at the port terminal.

- At destination, the ocean container is loaded on a chassis and delivered to the final destination via an over-the-road (OTR) truck for the dray segment of the shipment.

The reason why this may be a more costly intermodal move is, often, the shipper’s container is bound for an area of the country where the steamship carrier does not need the container for export. If this is the situation, the shipper often pays a premium to help offset the steamship carrier’s cost to get the container to an area of the country the steamship can use for another shipper.

In more extreme cases, the shipper will be responsible for the full cost to return the container to the original entry port.

As for inventory positioning, there is not an opportunity to either portion all or a portion of the contents of the import container because the container headed for an IPI move will be lifted from the steamship and placed directly on the railcar.

The reason positioning is important to a shipper is because consumers’ needs may change by the time the import container arrives. An example of this would be where one region of the country had an extended winter, while another had an early spring. In this case, it would make more sense to send the spring product where the customer shelf sell-through is creating out-of-stock situations much sooner than planned. The subsequent containers that were planned for replenishment could then be the initial stocking containers for the extended winter region.

We will address the above example in more detail in our next section.

Domestic Intermodal

Unlike IPI intermodal service, 53’ domestic intermodal service competes against truckload on service, price and capacity.

The 53’ containers never leave the confines of the domestic market, which consists of the USA, Canada and Mexico. While the majority of the domestic intermodal service is within the USA, there are plenty of competitive cross-border shipping opportunities.

There are both asset and non-asset intermodal providers. The biggest intermodal providers are going to say asset is the only game in town, but for those unfamiliar with intermodal service, we suggest reading Asset & Non-Asset blog comparing and contrasting the two types of IMC’s (intermodal marketing companies) to get a better understanding why the asset model may not necessarily be the best option for all shippers.

Domestic intermodal can be used in all the suggested methods to utilize rail in this article or as an alternative to truckload freight lanes.

One idea to add to the domestic intermodal service section is the idea of using domestic intermodal service to get on the other side of the two shortcomings IPI intermodal service that was mentioned previously, which are the issues of positioning the container in the location the steamship line wants it and the ability to make last second decisions on where to position the inventory in the retail channel.

The idea to bring forth is transloading the IPI containers at a DC within close proximity to the import location. Because of the increased cube of the 53’ intermodal container, the shipper essentially ships every fourth 53’ intermodal container for free. Also, this will allow the shipper to consolidate loads or expedite loads based on the very latest sell-through data.

The idea of transloading is not new. In fact, According to Alameda Corridor Transportation Authority (ACTA) growth of transloading in SoCal has increased from 43.5% in 2009 to 52.2% in 2018.

Intermodal Transportation Service / Container Options

There are a number of intermodal equipment types for shipers to tap into for intermodal freight capacity.

Each intermodal container equipment type has its strengths, which we will address below. (Please note these specifications are general and do vary based on manufacturer and / or freight service provider)

-

20’ International Container (ISO)

- Tare Weight: 5,050 lbs

- Payload Capacity: 62,150 lbs

- Cubic Capacity: 1,165 cu. ft.

- Internal Width: 7’ 8”

- Internal Height: 7’ 9 ⅞”

- Internal Length: 19’ 3”

- Door Opening: 7’ 8” x 7’ 5”

- Primary use is for import and export of product on the seas.

- Secondary use is for the re-positioning (re-po) market domestically where product is shipped in them at lower than average cost, to help offset the cost of getting the containers in markets more suitable for the steamship lines to get their containers filled for export.

- Great for using on product that will weight out before it cubes out.

- Container Specs

-

40’ International Container (ISO)

- Tare Weight: 8,000 lbs

- Payload Capacity: 59,200 lbs

- Cubic Capacity: 2,350 cu. ft.

- Internal Width: 7’ 8”

- Internal Height: 7’ 9 ⅞”

- Internal Length: 39’ 5”

- Door Opening: 7’ 8” x 7’ 5”

- Primary use is for import and export of product on the seas.

- Secondary use is for the re-positioning (re-po) market domestically where product is shipped in them at lower than average cost, to help offset the cost of getting the containers in markets more suitable for the steamship lines to get their containers filled for export.

- Great for using on product that will weight out before it cubes out.

- Container Specs

-

40’ High Cube International Container (ISO)

- Tare Weight: 8,775 lbs

- Payload Capacity: 58,425 lbs

- Cubic Capacity: 2,694 cu. ft.

- Internal Width: 7’ 8”

- Internal Height: 8’ 10”

- Internal Length: 39’ 5”

- Door Opening: 7’ 8” x 8’ 5 ½”

- Primary use is for import and export of product on the seas.

- Secondary use is for the re-positioning (re-po) market domestically where product is shipped in them at lower than average cost, to help offset the cost of getting the containers in markets more suitable for the steamship lines to get their containers filled for export.

- Great for using on product that will weight out before it cubes out.

- Container Specs

-

45’ International Container (ISO)

- Tare Weight: 9,810 lbs

- Payload Capacity: 62,990 lbs

- Cubic Capacity: 3,043 cu. ft.

- Internal Width: 7’ 8”

- Internal Height: 8’ 10”

- Internal Length: 44’ 5”

- Door Opening: 7’ 8” x 8’ 5 ½”

- Primary use is for import and export of product on the seas.

- Secondary use is for the re-positioning (re-po) market domestically where product is shipped in them at lower than average cost, to help offset the cost of getting the containers in markets more suitable for the steamship lines to get their containers filled for export.

- Container Specs

-

53’ Domestic Containers

- Tare Weight: 17,500 lbs (with chassis)

- Payload Capacity: 42,500 lbs

- Cubic Capacity: 3,967.4 cu. ft.

- Internal Width: 109.5”

- Internal Height: 99.38”

- Internal Length: 630.0”

- Door Opening: 8’ 3 ⅜” x 8’ 8 ½”

- Primary use is to provide 53’ capacity, to augment or supplant 53’ truckload capacity.

- Container Specs. (specs by intermodal provider)

-

53’ Domestic Trailers

- Tare Weight: 15,000 lbs

- Payload Capacity: 45,000 lbs

- Cubic Capacity: 3,975 cu. ft.

- Internal Width: 99.0”

- Internal Height: 110.0”

- Internal Length: 52’ 6”

- Door Opening: 99.0” x 110.0”

- Trailer Specs

-

Other Intermodal Rail Options

- Temperature controlled container equipment is available for both 53’ domestic and international ISO 20’ and 40’ containers. Their payload capacity is reduced in weight and cubic capacity because of the refrigeration unit.

- Temperature controlled trailers are also used for trailer-on-flatcar (TOFC) domestic intermodal capacity. As with all other temperature controlled equipment, cubic capacity and payload weight is reduced because of the need to cool the product being shipped.

- Flat racks is an option to ship products that are typically shipped through flatbed over-the-road (OTR) options. Be aware the flat rack options are limited to specific lanes or dedicated lanes assembled by a shipper because of capacity requirements.

- Bulk tank intermodal equipment is also an option for shippers that require bulk liquid or dry product they typically ship over rail or OTR tanker options.

- There is an option similar to bulk tank that involves putting a bladder in an intermodal container that can be used to ship bulk liquid.

The standard expectation of intermodal transit is truck, plus a day for shipments that stay within the same railroad network and truck, plus 2 days when the shipment has to be interlined between to railroads. Please take note that while the previous is the standard for domestic intermodal, there are some lanes that offer expedited domestic service and international standard or expedited shipping service levels may vary from their domestic counterparts.

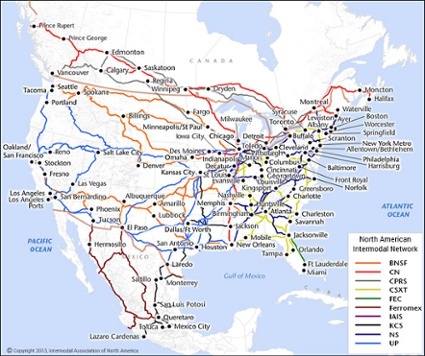

US, Canada and Mexico Intermodal Network

(subject to change)

(subject to change)

Load Planning & Cargo Damage Prevention

When utilizing intermodal versus truckload, understand there are specific guidelines to follow when loading out the container that differs from a truckload. It is key to understand the guidelines and engage your IMC (intermodal marketing company) if there are any questions. The IMC will bring their class I railroad representation into the conversation to provide the exact load plans to protect against damage. For more on the topic, we suggest the following webpage that outlines what to watch out for and provides additional resources.

Restricted vs Prohibited

When shipping intermodal, there are both restricted and prohibited product.

Prohibited products are items that, without exception, are not allowed to travel via rail.

Restricted products are defined as products that have rules and regulations that need to be followed for the shipment to move legally via rail. The shipper will be required to understand the rules and regulations and acknowledge these in a signed contract with the railroad transporting the product. The shipper’s IMC will help them through the process.

An example of a restricted intermodal product is coiled steel.

Match-back and Repositioning Market

A topic that has brushed on throughout this article is the re-po market.

As mentioned, the re-po market is associated with steamship lines re-positioning containers that were moved inland and need to find the most economical location to be filled with product to then be exported.

The benefit to shippers is cost, while the negative is service. On the cost front, shippers can gain savings as the steamship line would much rather ship the container with product than without, so they pick up some revenue on their asset. Keep in mind that for every two import boxes that only one is shipped back out with product. This 2-to-1 ratio costs steamship companies a tremendous amount of money to ship empty.

On the service front, these containers enter the market because of imports, so they are not always available in a market. This makes it difficult to plan around, but if possible makes for tremendous amount of savings for shippers. The caveat is “if possible”.

Check with your IMC (intermodal marketing company) to see if they offer re-po service.

In conclusion, we hope you have found there are several ways to access rail and intermodal to bring savings, capacity and sustainability to your supply chain, along with gaining some understanding of intermodal service.

If intermodal still sounds like a good fit for your company, we recommend reading our in-depth article entitled The Completed Guide to Intermodal Transportation, which is comprissed of the following chapters:

- INTERMODAL VS. TRUCKLOAD SHIPPING: A SIDE-BY-SIDE COMPARISON

- IS INTERMODAL TRANSPORTATION THE RIGHT FIT FOR YOUR COMPANY?

- COMMON ISSUES AND MISCONCEPTIONS AROUND INTERMODAL TRANSPORTATION

- THE BENEFITS OF INTERMODAL TRANSPORTATION

- THE COST OF INTERMODAL TRANSPORTATION

- GETTING STARTED WITH INTERMODAL TRANSPORTATION

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Get Updates

Categories

- Freight & Shipping Costs (53)

- Freight Broker (58)

- Freight Forwarder (2)

- Intermodal Transportation (182)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (415)

- Logistics Service Provider (76)

- LTL (39)

- Managed TMS (49)

- News (38)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (121)

- Warehousing & Distribution (49)