For years, InTek has been laser focused on domestic intermodal as an alternative to truckload options for price and capacity requirements.

Our initial push into domestic intermodal (in order of importance) was for price, supply chain sustainability and capacity. The conviction InTek has for domestic intermodal has not changed, although capacity and price has changed positions in our ranking.

This change occurred at the end of 2017, as we saw the freight capacity challenges of 2018 taking shape. The freight capacity challenges brought on by the COVID19 pandemic solidified capacity as the number one reason for shippers to have an intermodal component of their 53’ freight strategy.

With that said, we put extensive focus on publishing intermodal articles within the InTek Learning Center; our leadership team participated in various industry conferences and webcasts sponsored by IANA and TIA; continued to up our presence in the intermodal community with InTek’s President, Shelli Austin adding the Vice-Chair position on the IANA Board; and we contributed to a number of industry articles published by the Journal of Commerce and FreightWaves.

Examples of Learning Center articles and external publications are listed next.

Most Read Intermodal Articles Published within the InTek Learning Center:

- Best Intermodal Companies (And How to Choose)

- Pros & Cons of Using Intermodal for Your Company's Shipments

- JB Hunt's Intermodal Model vs Class I Railroads: Pros and Cons of Each

- Why Diversification of Truckload & Intermodal is Key to Logistics Success

- Asset vs Non-Asset Intermodal Freight Providers: A Detailed Comparison

- Cost of Intermodal Transportation Services (Rates, Fees & Variables)

- 11 Differences Between Intermodal and Truckload Every Shipper Should Know

- Intermodal Marketing Company (IMC) - (Definition, Purpose & Value)

- How to Ship Intermodal Without Damage

FreightWaves and Journal of Commerce Articles:

- US rail freight: Will domestic intermodal contract pricing hold?

- Railroads face major challenges to jump-start their intermodal business

In the external articles InTek’s CEO, Rick LaGore, spoke on the intermodal market dynamics and the value proposition JB Hunt offers shippers that positions them as the 1,600 pound gorilla in the space that all IMC’s are compared to on service and price.

These two external articles, in particular, were challenged by our peers because we spoke so positively about our competition, but as we see it: transparency is the best path to success; every company brings a slightly different value proposition that positions itself to be a better fit for one company versus another; and we are not as vain to think we are the best for all so why not help shippers find the best fit for their business requirements.

The 5 Largest Intermodal Service Providers

So, there you have it. The largest and best known intermodal transportation providers.

While the top 5 freight companies are great at what they do, if these are the only intermodal providers your business is working with, then you are missing out on roughly 1/3 of the total intermodal capacity available in the marketplace.

So, for those of you that recall Paul Harvey’s radio show and his well known phrase “The Rest of the Story” is where we will take this article next.

Intermodal Providers Beyond JB Hunt, Hub Group, Schneider, STG & Swift

While the top five intermodal providers own the intermodal market and mind share, there are other intermodal service providers or as the industry calls them, intermodal marketing companies (IMCs) that bring a great deal of capacity to the intermodal marketplace and their own twist on the servicing intermodal shippers that can make them a better fit for a business.

Over the next several paragraphs, we’ll walk through the other options which takes the path of discussing intermodal marketing companies (IMCs), types of IMCs and then share the companies that own the 53’ intermodal boxes we all use to provide the door-to-door intermodal freight capacity and service to shippers.

Definition of an Intermodal IMC

The phrase IMC does the intermodal freight providers of all sizes a disservice. The phrase makes intermodal service providers sound like nothing more than sales agents or an intermodal freight broker, which is furthest from the truth. The fact of the matter is all intermodal service providers, including the five largest intermodal providers, are IMCs also.

The phrase IMC does the intermodal freight providers of all sizes a disservice. The phrase makes intermodal service providers sound like nothing more than sales agents or an intermodal freight broker, which is furthest from the truth. The fact of the matter is all intermodal service providers, including the five largest intermodal providers, are IMCs also.

To start, the United States based class I railroads do not sell their intermodal transportation services retail, meaning they do not sell their intermodal service directly to shippers. Instead class I railroads sell wholesale to IMCs who then go on to sell and operate the intermodal business on behalf of the railroads.

IMC’s not only sell the intermodal service, but they become the main point of contact for the shippers utilizing intermodal. The IMC secures the container, chassis and dray capacity. Once the assets are brought together to meet the required arrival date (RAD date), the IMC books the freight on the railroad intermodal, schedules the ingate and outgate activity and provides the customer service support and all the reporting the customer requires for its business. After the intermodal load delivers successfully the IMC provides a single invoice that encompasses the full door-to-door move to the shipper to then pay.

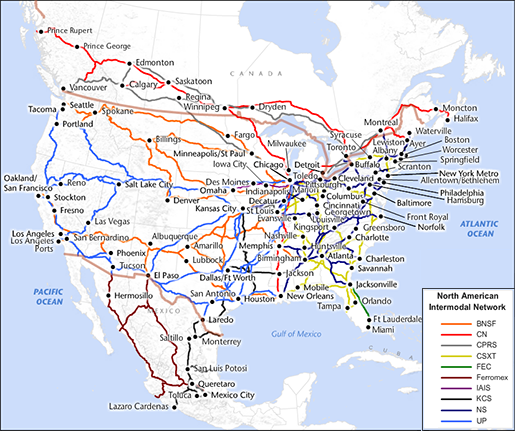

The current US railroad infrastructure is split between East (Norfolk Southern and CSX) and West (Union Pacific and BNSF) Coast Railroads with the Mississippi River essentially being the dividing line. Because of this structure the best way a shipper can access all intermodal points is to connect with an IMC which manages all points and interlines to move freight among the various US class 1 railroads.

Based on intermodal container, chassis and dray asset ownership breaks IMC’s into three different structures.

Types of Intermodal Service Providers (IMC’)

- Bi-Modal

- Asset-Lite

- Non-Asset

Before outlining each of the IMC provider types we need to realign some thinking where an IMC may be thought to be a freight broker. InTek has nothing against freight brokers, as we are truckload broker, but we are also an IMC.

There are plenty of freight brokers that provide intermodal freight capacity for their customers, but they are getting it through an IMC not a direct relationship with the railroads.

Now the thought may be there is not a difference going through an IMC than going to a freight broker for truckload capacity, but there is and it gets down to the additional value a freight broker brings to the truckload market by efficiently connecting shippers with the highly fragmented trucking market where 97% of truckload capacity is coming for carriers with less than 20 trucks.

Adding to the discussion is unlike the truckload industry where motor carriers own the assets from origin-to-destination, there is no single entity that owns all the assets used in the intermodal shipment process. The class I railroads do not own all the assets and the JB Hunts of the world do not either, although the class I railroads come very close to owning 100% of the assets with the tracks, intermodal ramps, locomotive and intermodal containers and in some markets drayage assets.

So with all the background behind us, let’s look at the three types of IMCs.

Definition of Each Type of Intermodal IMC

Bi-Modal IMC

Bi-Modal IMC

The bi-modal IMCs are considered asset based IMC’s. The assets a bi-modal IMCs own are intermodal containers, chassis and the majority of their dray capacity. The best example of a bi-modal IMC is JB Hunt.

Asset-Lite IMC

The asset-lite IMC providers own COFC boxes and a portion of their drayage capacity. The reason these IMCs are considered asset-lite is not only do they own some assets, but they also dip into the class I railroad owned equipment along with supplementing their drayage asset capacity with other companies.

Non-Asset IMC

The non-asset intermodal IMC providers do not own COFC boxes or dray assets. The non-asst IMCs work directly with the class I railroads for their door-to-door intermodal services through two service options: door-to-door and ramp-to-ramp intermodal service options. The shipper does not see a difference, but there are typically more options for those non-asset IMCs that have both service options available to them. InTek Freight & Logistics is an example of a non-asset IMC.

Rail Retailers

Another segment of the intermodal market includes the railroads selling retail intermodal freight capacity direct to shippers: CN (Candian National) and CP (Canadian Pacific).

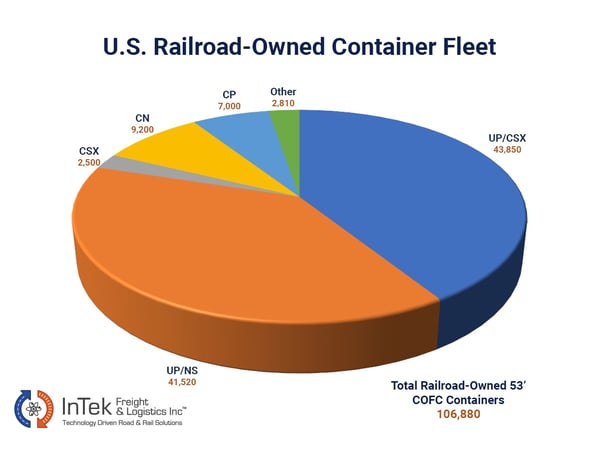

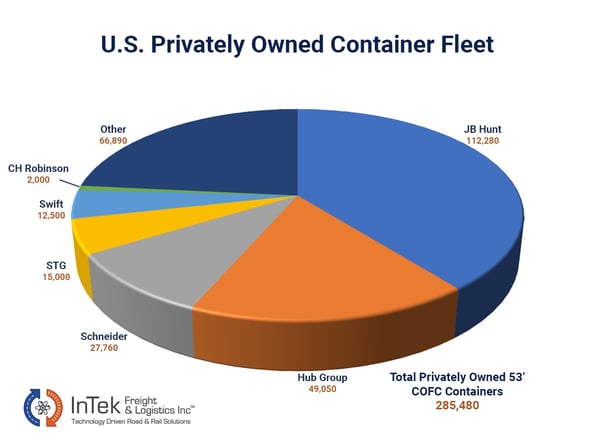

Intermodal Box Ownership

As the charts indicate below, there are both private and public box ownership options, with 67% of the containers being publicly owned and 33% privately owned.

Private intermodal boxes are those owned primarily by the bi-modal IMC’s and are the top five IMC’s listed earlier in the article: JB Hunt, Hub Group, Schneider, STG and Swift.

Public intermodal boxes are owned by the class I railroads and are used by asset-lite and non-asset IMC’s. Both IMC’s do connect in with some of the public box owners also to help fill out its capacity options on lanes that are BNSF oriented.

JB Hunt is the single largest owner of intermodal boxes with roughly 97K, while the railroads come in second at 88K intermodal containers.

The mix has moved more toward private box ownership, as JB Hunt continues to increase its buy levels at a higher clip than others.

Shippers are Missing Out by Not Diversifying Intermodal Capacity Outside of the Bi-Modal IMCs

With intermodal IMCs defined and intermodal container ownership laid out in full, the rest of the story is there are more options beyond just the top five intermodal providers that hold the largest mindshare.

-

One-Third of Intermodal Capacity

- The bi-modals hold 67% of the total intermodal box market share, with the balance sitting with the railroads. By not tapping into the non-asset IMCs, which are the largest user of the railroad owned boxes, shippers are missing out on additional capacity options.

-

Options to Diversify Risk by IMC Type and Railroad

Options to Diversify Risk by IMC Type and Railroad- On intermodal freight lanes that both railroads operate shippers give themselves leverage on pricing and service when one of the railroads struggles with service for a reason specific to them.

- To add to this segment, while the railroads do have similar origin / destination combinations (O/D pairings) on some lanes their footprint is not exactly the same so pricing can be improved because the ramp is closer with one versus the other or the tracking runs through an area that may not have a weather or natural disaster issue associated with it giving way to better pricing and service.

- Shippers will better service their markets by holding intermodal contracts with both bi-modals and non-asset IMCs.

- There are two Western US railroads in the Union Pacific (UP) and BNSF. The bi-modal IMCs primarily source their freight with BNSF, while the non-asset IMCs source with the Union Pacific.

-

Pricing Advantages Had by Other O/D Ramp Combinations

- A couple of quick examples include Salt Lake City for non-asset intermodal IMCs and Phoenix for bi-modal options.

- Many of the O/D pairings for intermodal can be similar among all class I railroads operate, but the other situation stand true also where the railroads will have slightly different intermodal ramp combinations. The differences can drive better pricing for shippers that utilize both a bi-modal and non-asset IMC.

-

Pricing Power

- This means shippers do not have to be held hostage by a bi-modal or non-asset IMC.

- So, when the bi-modal decides to increase its “peak season” charges or does not have boxes in the area to fulfill the service requirements the shipper can lean more on its non-asset IMC and vice-versa.

- With those similar O/D pairings for both bi-modal and non-asset IMCs the shipper picks up pricing power by the ability to negotiate the two against each other.

Next Steps in Obtaining Additional Intermodal Capacity Options

The good news coming out of this article is shippers have a number of intermodal capacity options.

The good news coming out of this article is shippers have a number of intermodal capacity options.

Service is the critical factor for all IMCs and how they obtain it differs by the three IMC classes discussed earlier.

Keep in mind that with only a handful North American railroads, every IMC is using the same railroad for their long-haul, whether asset or non-asset based.

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (52)

- Freight Broker (58)

- Freight Forwarder (2)

- Intermodal Transportation (180)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (413)

- Logistics Service Provider (76)

- LTL (39)

- Managed TMS (49)

- News (38)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (120)

- Warehousing & Distribution (49)

(

(