What do you think of when you hear the word intermodal …slow, unreliable, complicated?

Intermodal is the use of two or more modes of freight, such as truck and rail, to transport goods from a shipper to a consignee. In the case we are talking about in this article:

-

A truck handles dray from the origin DC or warehouse to the railroad ramp.

-

The long-haul segment of the freight is run on the rail.

-

A truck closes out the shipment through a dray move from the destination intermodal ramp to the DC or warehouse.

Intermodal can either be container on flat car (COFC) or trailer on flat car (TOFC).

The railroads have made, and continue to make, substantial investments in infrastructure, technology and people to give intermodal truck-like characteristics while being cost and transit competitive on lanes over 700 miles. The investments have positioned intermodal as the fastest growing segment in domestic transportation and pushed what many call the “highway-to-rail conversion” to the next level.

Various studies have concluded that non-intermodal users could shift anywhere from 10% to 40% of their truckload volume to intermodal, while current intermodal users could shift another 29% from truckload to intermodal.

Those stats show that many shippers are holding back on the tremendous value intermodal can bring to their organization, which begs the question, why?

Having talked to 100’s of these reluctant intermodal shippers, we found the reason is because they hold onto many misconceptions about intermodal transportation. From our experience in helping many companies successfully convert some of their freight lanes from truckload for improved cost and more capacity find much of the misconceptions were created years ago, although have since been corrected but continue to live in the folklore of many transportation decision makers’ offices today.

If you are one of those shippers sitting on the sidelines, we are hoping that by walking through the misconceptions and providing some “real-life” data we will help convince you to dig deeper to see if intermodal would be a good fit for your company.

Top 10 Intermodal Misconceptions

-

Slow Transit

-

Unreliable

-

Lacks Visibility

-

Damage

-

Less Secure

-

Weight

-

Only Makes Sense in High Fuel Environment

-

Lacks Competition

-

Box Size

-

Complicated

Most Common Misconceptions of Intermodal

Slow Transit Time

The first misconception we hear is “rail equals slow.” This is no longer true. Intermodal service transit is typically truck, plus a day...not forever and a day. Intermodal transit moves the same as a truck plus two days when the load needs to be interlined between two railroads.

An example of an interline is where a shipment is a cross country lane that originates on the Union Pacific in Los Angeles, then is steel wheel interlined to Norfolk Southern in Chicago to continue through to the New Jersey market.

Some intermodal lanes have expedited service that have the same transit as truck. Transits do stretch when the shipment needs to be interlined between railroads.

Unreliable

The belief that rail carriers are unreliable; aren’t able to follow through on their commitments; and drop the ball on making their deadlines is still the image for some shippers.

The thought we hear from shippers with this misconception is they feel no one is in control of the load; that has the opportunity to create a never-ending series of finger pointing conversations when something goes wrong with a shipment.

To help debunk this unreliable thought, we’d like to share that intermodal is frequently used for big box retail shipments. This would not be possible if it weren’t for reliable service levels. Could you image the fines placed upon a shipper if they used intermodal over-and-over again only to be hit with late fines on every load? The company would lose money on every load they shipped into the location.

While reliability was a problem not so long ago, the investments made by the class I railroads in infrastructure, technology and people has positioned well to gain the trust of the shippers.

To take reliability a step further, our experience has been that intermodal is more reliable than trucking the freight with our customers with well over 50% of our 53’ capacity moving for shippers on 53’ domestic intermodal containers. As for big box retails, we love to bring intermodal options to shippers for their promotional orders that require shippers to push a great deal of capacity out to cover.

The largest truckload carriers now own roughly 43.5% of intermodal boxes. These asset carriers made this investment because they believe intermodal service is reliable and is the replacement for long-haul in the near future because of the various challenges they face with driver shortages, regulations, fuel, insurance, etc. that we’ve all heard and read in the articles on trucking’s challenges.

To conclude the liability section, think of it this way: Moving freight always creates an opening for an issue. A shipper is essentially buying a mini mobile warehouse to move its goods to its customer with a number of operational opportunities for failure. The key is to align with a reliable intermodal service provider that will white glove your shipment from origin to destination to deliver the on-time performance your company requires.

Lacks Visibility

Intermodal visibility is far better than truckload. In fact, intermodal track and trace visibility is similar to small parcel shipments, which is illustrated in the chart below. At each point of an intermodal journey, there is a scan of the wellcar that is moving the intermodal container or over-the-road (OTR) trailer.

Damage

Damage is one of the biggest misconceptions in the freight and logistics industry. Some trucking advocates would like shippers to believe the combination of truck and rail service will only heighten the possibility of damage, but that’s simply not true. The reality is by moving via rail for the long-haul segment of a shipment and truck for the short haul dray segments of a shipment, you optimize the best attributes of each freight mode.

Now some problems in the past used to be caused when logistics providers and brokers miscommunicated when moving a company’s freight for the lowest price that they may be using intermodal. The result is the shipper does not load the shipment properly for their product to transport properly in the intermodal container or OTR trailer.

The key to all of the damage topic is to think of as truckload-like, not exactly like truckload. There are loading requirements that must be adhered to for success. With the blocking and bracing measures put in place, the chances of damage occurring to your intermodal shipment are no more than trucking alone. The railroads have damage prevention units that assist shippers along the way to help ensure damage free-delivery of your products.

How to Ship Intermodal Without Damage is a quick read to gain a refresher on the topic for more on the topic.

Less Secure

The loss side of intermodal is an odd misconception because it is so far off the tracks.

Security is an advantage for intermodal. For shippers having high-value product, intermodal has a significant advantage since it is not on the road or not open to driver challenges. While farfetched, the example I heard at one conference is “have you ever heard of the train stopping at a rest stop, then running home to take care of an issue” does help bring some clarity to security. The majority of the shipment is on the rail with no access to others, thus making the security significantly better than trucking the product over hundreds of miles.

Also, if requested, a shipper’s intermodal container shipment can be placed at the bottom of the double-stack on the railroad well car. In this case, the doors cannot even be opened.

Weight

Intermodal weight can be an issue for many shippers, which is probably why Intermodal Weight - The Most Common Issue for Shippers is the most read blog from InTek.

Intermodal weight can be an issue for many shippers, which is probably why Intermodal Weight - The Most Common Issue for Shippers is the most read blog from InTek.

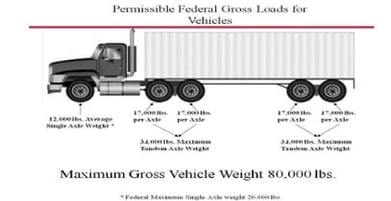

The typical weight allowable to load on a domestic intermodal container is 42,500, which is 2,500 less than an OTR shipment but that is just the start.

For a shipment to be legal, there are weight requirements on steer and axles, as illustrated above. Shippers not familiar with intermodal must become acquainted with the term “harmonic vibration,” which is a gentle vibration that moves pallets of freight in an intermodal shipment.

So, the troublesome part and the reason for the misconception of the weight and damage is harmonic vibration; this is easily addressed with a 2x4 and a few 16 penny nails to affix the board to the container or truckload floor.

The harmonic vibration is also the cause of many weight, damage and accessorial charges because a load may be legal at origin, but not at destination because the load shifts during transit and while the load is not over gross weight it is over on either the drive or steer points as is illustrated in the below graphic.

A quick note on harmonic vibration before moving to the next topic: Do not get too worried about the vibration as a damage factor in itself. The vibration is more similar to that found in the old time electric vibration football game kids played years ago where it is a gentle vibration that will shift freight front to back and left to right in a container, hence the need for blocking and bracing. This is a much different experience for cargo than truckload shifts.

Only Makes Sense in High Fuel Environment

The theory that domestic intermodal transportation only makes sense when diesel fuel prices are on the upswing is just not true. Pricing does have some connection to diesel fuel prices, but actually, pricing is more aligned to supply and demand of a lane.

There are times when it appears there is a correlation between fuel and price, but contract and spot rates are all about the law of supply and demand.

The InTek Freight & Logistics Intermodal Spot Rate Index against the EIA Diesel Fuel Price can be found published weekly on our blog page.

Competition

Another area of misconception is the railroads don’t need to compete. With the consolidations and mergers of the North American railways and with each specializing in certain corridors, there are very few carriers available to compete with each other. However, the railroads are focused on highway-to-rail conversion and know their potential customers are currently using trucks to haul shipments, and this is where they are competing hard for business.

For this reason, the railways are working closely with trucking companies to offer truck and rail combinations with flexibility, improved speed and lower costs.

Box Size

Here is an interesting misconception. We have had several shippers indicate they cannot convert their loads from truckload to intermodal because the boxes are too small for their product, but that is because they are thinking about the 20’ and 40’ ISO (international standardization organization) containers that ship on the ocean.

These shippers are unaware that there are 53' domestic intermodal that move only over land in US, Canada and Mexico.

For the specifics on intermodal containers, the 53' domestic box internal size chart is available via the link provided.

Complicated

We’re almost to the end and you may be thinking great, but intermodal is all too complicated and will not fit into my transportation management system TMS optimization engines.

Like many of the misconceptions, this is a relic of the past. Years ago intermodal shippers had to arrangement the origin dray, the line haul, the destination dray, multiple manifests, manage the hand-offs, do the tracking, and then reconcile all three invoices versus the one they would get with their truck shipments.

Today, intermodal is simply a phone call or email and the intermodal professionals, IMC (intermodal marketing company), and railroad work hand-in-hand to offer a door-to-door service that takes all the complication headaches away from the shipper.

The door-to-door intermodal service looks just like a truck. You tender the shipment to the IMC and they take care of the rest and at the end of a successful shipment send a single invoice.

Final Thoughts on Intermodal Misconceptions

-

On the reliability front, know that nine times out of ten, the issue is not the railroad but with either dray leg of the shipment.

-

So, the three biggest questions to be answered when choosing an intermodal transportation provider are:

- How do they control dray?

- What processes do they have in place when a failure occurs?

-

What percentage of their business is domestic intermodal?

-

Always remember intermodal is truck-like, not exactly like truck. By having this front of mind, you’ll ask questions and make decisions that are better aligned with the mode.

-

Last, but not least is to align with an intermodal provider that utilizes intermodal as one of its key strengths, not one that just uses intermodal as a back-up plan. There are plenty of us out there and for more on the topic read Best Intermodal Companies (And How to Choose).

Hopefully we’ve been able to help clear up some of the bigger misconceptions and objections that may be keeping you on the sidelines of intermodal.

Intermodal is not the end-all-be-all, just as is the case with all freight modes, but when your company has freight lanes that are great for intermodal, then jump in without the fear of the unknown and we’d love to be a part of the conversation to help you through your buying journey.

Until then, remember the advantages of intermodal include: cost savings, competitive transits, shipment protection, enhances capacity requirements, decrease highway congestion and with an improved carbon footprint.

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (54)

- Freight Broker (60)

- Freight Forwarder (2)

- Intermodal Transportation (184)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (420)

- Logistics Service Provider (77)

- LTL (39)

- Managed TMS (49)

- News (39)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (122)

- Warehousing & Distribution (50)