As part of the decision process a logistics professional goes through to bring an intermodal strategy to their company one of the most pressing questions they ask themselves is whether an asset or non-asset intermodal provider will be the best fit for their business requirements.

The largest and best known intermodal freight service providers are those that own intermodal containers and all or a portion of the dray equipment and drivers that move their freight, but there is more to intermodal than owning those assets.

Over the next several paragraphs we will share our perspective after having work with hundreds of shippers looking for an intermodal freight solution for their company, as it relates to service, price, capacity and stability.

Before jumping in with both feet on the topic of asset vs non-asset intermodal service providers we need to take a quick sidebar for those new intermodal. The term to know for an intermodal service provider is they are identified in the market as IMC’s or intermodal marketing companies and both asset and non-asset models exist, although not in the same way asset motor carriers and freight brokers coexist.

Two articles worth reading for those new to intermodal include:

- Asset vs Non-Asset Intermodal Freight Providers: A Detailed Comparison

- This article provides a deep dive into comparing the pros and cons of both intermodal service models.

- Intermodal Marketing Company (IMC) - (Definition, Purpose & Value)

- An IMC can be confusing to some not familiar with the topic, which this article addresses in full detail.

Non-Asset Intermodal IMCs Value to Shippers

To start, the non-asset IMC intermodal provider does not own intermodal containers, but buyers of intermodal transportation services should not think of them as freight brokers.

The reason to not think of a non-asset IMC as a broker is it has a dedicated, contractual relationship with all the North American class I railroads to utilize its assets on behalf of the railroad. The reason for this relationship is the railroads do not sell their intermodal services direct with shippers, but instead through non-asset IMCs.

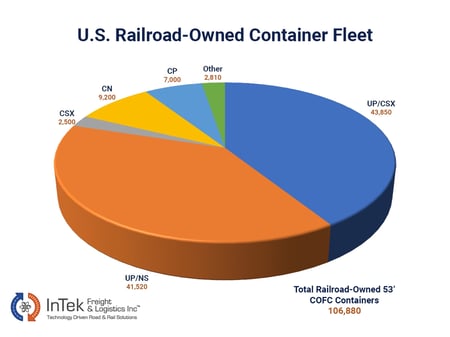

The US railroads that own assets that they then market through IMCs include: Union Pacific, Norfolk Southern and CSX. The BNSF railroad does not own containers, but instead runs the trains the asset IMCs utilize to move the boxes they own.

Non-asset IMCs have direct contractual relationships with the Class I Railroads to support year round pricing, guaranteed capacity and protection against peak season constrained market intermodal box charges. In other words, the non-asset IMC provides the same pricing structure provided by the asset IMCs with the intermodal container assets provided by the class I railroads.

The non-asset IMC contractual commitments are a binding three-way agreement between the IMC, shipper and railroad gives shippers year round capacity commitments that they would find with the asset intermodal IMCs.

In conclusion, the value a non-asset IMC brings to a shipper is the contractual commitments they find with asset IMCs, along with flexibility not found in the asset IMC model.

Main Value of Non-Asset IMC’s is Flexibility

The ability to shift a shipper’s freight volume from one railroad to another railroad when there are service issues unique to one railroad at a specific time.

The ability to shift a shipper’s freight volume from one railroad to another railroad when there are service issues unique to one railroad at a specific time.- Options to utilize an asset IMC when it is more advantageous to the shipper.

- Augment intermodal capacity and service with truckload options when business or service requires a truckload capacity option.

- A one-stop shop for a shipper’s complete 53’ North American intermodal capacity.

- Additionally, many non-asset IMC’s have additional flexibility to utilize TOFC (trailer on flatcar) intermodal options and tap into the 40’ and 45’ ISO intermodal repositioning programs directly with the ocean freight companies.

Asset Intermodal IMC Overview

On the other side of the intermodal service provider market sits the asset IMC.

On the other side of the intermodal service provider market sits the asset IMC.

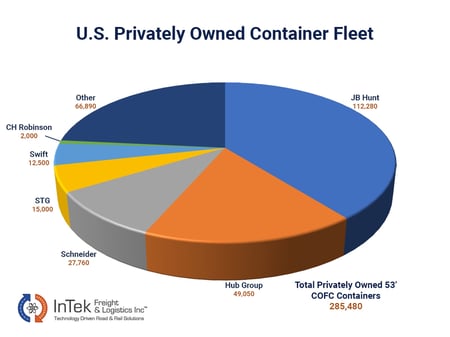

This segment of the intermodal market is the one most familiar with shippers, with JB Hunt sitting at the top of the list.

An asset IMC owns the 53’ intermodal containers and has overarching contractual commitments to the class I railroads they depend on to operate the railroad segment of their intermodal service.

Asset IMC’s provide a great service at a tremendous price on major intermodal routes that work well within their network.

The challenge for an asset IMC is twofold:

- Because of their dedication to yield and contractual volume commitments to railroads, the asset IMC provides intermodal service only on their intermodal containers.

- The asset IMC’s are publicly traded companies working yield and current quarter profitability targets focused on pleasing their board and stockholders can lead to less optimal service and pricing in constrained freight markets.

- In the year of and the year following a capacity constrained freight market the asset IMC’s perform network rationalization reviews to ensure they are focused on optimizing their freight lanes for the best service and profitability, which can lead to some of their customers taking on more costs and less capacity than budgeted.

To close the discussion on the asset IMC, understand the model brings tremendous value for the right shipper, but for others it can be a bit confining and introduce risk into a shipper’s supply chain if not augmented with the flexibility a non-asset IMC provides.

Conclusion of Non-Asset Intermodal IMC’s

The value a non-asset 3PL provides is it offers the most options to help shippers maximize their logistics and supply chain strategies, but as we often share in other articles diversification of freight mode and providers within each mode is the best way to protect against capacity constrained years.

So with the previous comment in mind, a balance between non-asset and asset IMCs will produce the best results for larger shippers and for the smaller to mid-market companies that do not have enough volume to spread their risk around a non-asset IMC would be their best choice.

In addition to the previously mentioned articles, listed below are other articles our readers found helpful in their decision process to utilize intermodal in their logistics strategy:

- Pros & Cons of Using Intermodal for Your Company's Shipments

- Intermodal Options Beyond JB Hunt, Hub Group, Schneider, XPO & Swift

- JB Hunt's Intermodal Model vs Class I Railroads: Pros and Cons of Each

- Why Diversification of Truckload & Intermodal is Key to Logistics Success

- Cost of Intermodal Transportation Services (Rates, Fees & Variables)

- 11 Differences Between Intermodal and Truckload Every Shipper Should Know

- How to Ship Intermodal Without Damage

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Get Updates

Featured Articles

Categories

- Freight & Shipping Costs (54)

- Freight Broker (60)

- Freight Forwarder (2)

- Intermodal Transportation (184)

- International & Cross Border Logistics (43)

- Logistics & Supply Chain (420)

- Logistics Service Provider (77)

- LTL (39)

- Managed TMS (49)

- News (39)

- Supply Chain Sustainability (12)

- Transportation Management System (37)

- Truckload (122)

- Warehousing & Distribution (50)